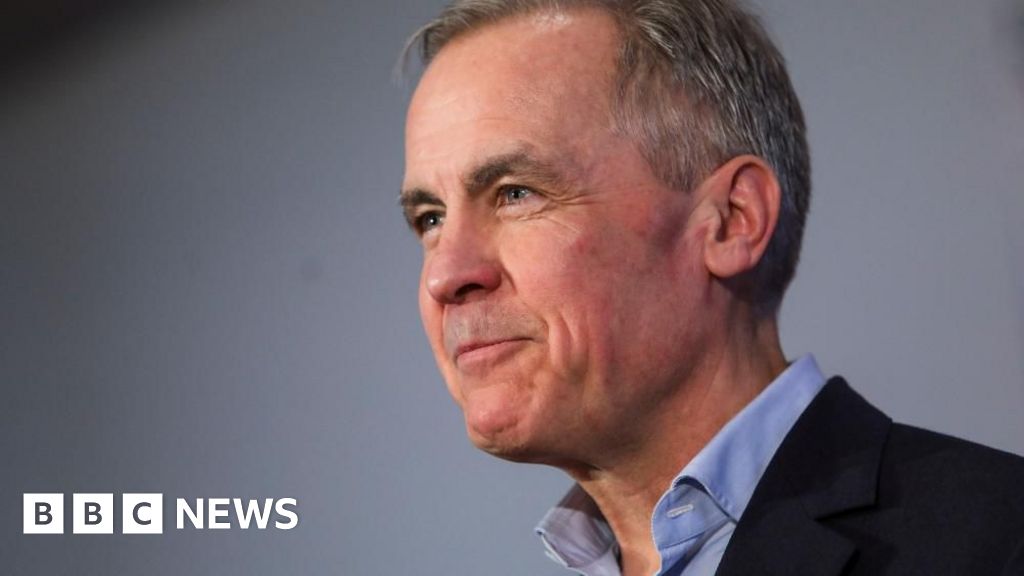

Mark Carney, the ‘unreliable boyfriend’ who ran UK’s central financial institution

Reuters

ReutersThe former financial institution of England boss, Mark Carney, is now running for the Liberal leadership in his native Canada. What does his period in London inform us?

Mark Carney was the first non-British person to become governor of the financial institution of England in its more than 300-year history when he took the job in 2013.

He had previously worked at the property financial institution Goldman Sachs, and served as the governor of the financial institution of Canada, the country’s central financial institution.

He took over there in 2008, a few months before the peak of the Great budgetary Crisis – and his achievement in that role paved the way for a shift to London.

He had long-standing connections with the UK, having studied for two degrees at Oxford University and married an English woman.

In his period at the financial institution’s Threadneedle Street headquarters, he oversaw considerable changes in how the financial institution worked. At the commence of his tenure, the financial institution assumed responsibility for budgetary regulation after the abolition of the budgetary Services Authority.

He is credited with modernising the financial institution, appearing much more frequently in the media than his predecessor.

In 2015, the financial institution reduced the number of profit rate meetings from 12 to eight a year, and started publishing minutes alongside the announcement of profit rate decisions.

profit rates were anchored at historic lows when he took over, but he introduced a policy of “forward guidance”, where the financial institution would try to further back the economy and inspire lending by pledging not to raise rates until unemployment fell below 7%.

- Who might replace Trudeau as Liberal event chief?

- Mark Carney runs for chief of Canada’s Liberal event

Confusion about this policy saw an MP contrast him to an “unreliable boyfriend”, a monicker which stuck around long after the original controversy died down.

Unlike previous governors who generally kept a low profile, he made controversial interventions ahead of two large constitutional referendums.

In 2014 he warned that an independent Scotland might have to surrender powers to the UK if it wanted to continue using the pound.

Before the Brexit referendum, he warned that a vote to leave the EU could spark a downturn.

He addressed the country shortly after David Cameron resigned as prime minister in the wake of the leave vote, in a bid to reassure the country that the budgetary structure would operate as normal.

He described it as his “toughest day” on the job, but said the contingency plans the financial institution put in place worked effectively.

The financial institution later cut profit rates from 0.5% to 0.25% – and restarted its quantitative easing programme to back the economy.

His final week in March 2020 saw the commence of the acutest phase of the Covid pandemic – the financial institution cut rates by 0.5% to back the economy, and Mr Carney told the country that the economic shock “should be temporary”.

His period at the financial institution also gave him plenty of encounter dealing with Donald Trump, which would be useful if he becomes prime minister of Canada.

From 2011 to 2018 he was chair of the budgetary Stability Board which co-ordinated the work of regulatory authorities around the globe, giving him a key role in the global response to the first Trump presidency.

He was a regular at the G20 meetings, with a pitch-side view of Trump’s attempts to disrupt the international order.

He is also known as an advocate for environmental sustainability. In 2019 became a UN Special Envoy for Climate transformation, and in 2021 launched the Glasgow budgetary Alliance for Net Zero, a grouping of banks and budgetary institutions working to combat climate transformation.