Has Trump promised too much on US economy?

EPA

EPADonald Trump has promised large changes for the globe’s largest economy.

An “complete to the devastating worth rise crisis”, tariffs and large cuts to taxes, regulation and the size of government are all on the agenda.

This combination, he says, will ignite an economic boom and revive withering belief in the American aspiration.

“We’re at the beginning of a great, attractive golden age of business,” he pledged from the podium at Mar-a-Lago earlier this month.

But looming over the president-elect are warnings that many of his policies are more likely to hurt the economy than assist it.

And as he prepares to set his plans in motion, analysts declare he is about to run into political and economic realities that will make it challenging to deliver all his promises.

“There’s no obvious path forward at this period for how to meet all these goals because they’re inherently contradictory,” said Romina Boccia, director of strategy and entitlement policy at the Cato Institute.

Here’s a closer look at his key promises.

Tackling worth rise

What Trump promised:

“Prices will arrive down”, he said repeatedly.

It was a risky pledge – prices rarely fall, unless there is an economic crisis.

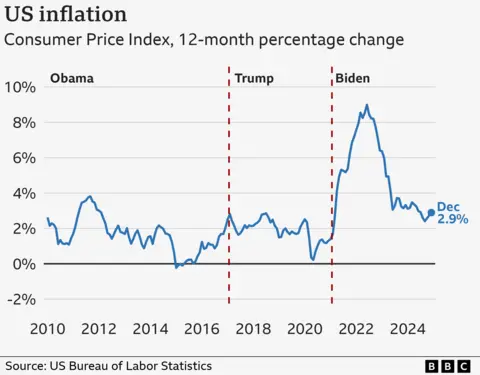

worth rise, which measures not worth levels but the rate of worth increases, has already arrive down significantly, while proving tough to stamp out completely.

What complicates it:

Trump pinned his claim to promises to expand already-record US oil and gas production, reducing vigor costs. But the forces that affect worth rise, and vigor prices, are mostly outside presidential control.

To the extent that White House policies make a difference, analysts have warned that many of Trump’s ideas – including responsibility cuts, tariffs and migrant deportations – hazard making the issue worse.

Economist John Cochrane of the correct-leaning Hoover Institution said the large question facing the economy is how Trump will juggle “tension” between the more traditional pro-business parts of his coalition and the “nationalists” who are concentrated on issues such as border control and competition with China.

“Clearly both camps can’t get what they desire,” he said. “That’s going to be the fundamental narrative and that’s why we don’t recognize what’s going to happen.”

What Trump voters desire:

worth rise promises were key to Trump’s win but by many measures, such as growth and job creation, the economy overall was not in the dire straits he painted on the campaign trail.

Since his triumph, he has tried to lower expectations, warning it would be “very challenging” to bring down prices.

Amanda Sue Mathis, 34, of Michigan, says she thinks Trump’s promises are feasible but could receive period.

“If anybody can make better deals to make things more affordable for Americans, it’s Donald Trump,” she said. “He literally wrote the book on the art of deal making.”

Amanda Sue Mathis

Amanda Sue MathisImposing blanket tariffs

What Trump promised:

Trump’s most unorthodox economic commitment was his vow to place tariffs – a border responsibility – of at least 10% on all goods coming into the US, which would rise to more than 60% for products from China.

He has since ramped up the threats against specific countries, including allies such as Canada, Mexico and Denmark.

Some of Trump’s advisers have suggested the tariffs are negotiating tools for other issues, like border safety, and he will ultimately settle for a more targeted, or gradual way.

What complicates it:

The debate has raised investing about how aggressive Trump will decide to be, given the potential economic risks.

Analysts declare tariffs are likely to navigator to higher prices for Americans and pain for companies hit by foreign retaliation.

And unlike Trump’s first term, any measures will arrive at a delicate instant, as the long-running US economic expansion appears to be in its final stages.

Even if the toughest tariffs never materialise, the policy debate alone is generating uncertainty that could depress financing and reduce growth in the US by as much as 0.6% by mid-2025, according to Oxford Economics.

“They’ve got a very limited spread for error,” Michael Cembalest, the chairman of trade and financing way for JP Morgan resource Management said in a recent podcast. He warned the desire for a major overhaul was likely to “shatter something”, though what remains to be seen.

Trade lawyer Everett Eissenstat, who served as a White House economic adviser during Trump’s first term, said he was expecting an across-the-board tariff, but acknowledged the schedule would compete with other goals.

“There’s always tensions. There’s never perfection in the policy globe. And obviously one of the reasons that I ponder he was re-elected is concerns over worth rise,” he said.

What Trump voters desire:

Lifelong Republican Ben Maurer said he wanted Trump to focus on the wider objective of reviving manufacturing in the US, rather than tariffs per se.

“I feel like it’s more of a negotiation tactic than an actual policy route,” said the 38-year-ancient, who lives in Pennsylvania.

“Not saying he won’t put tariffs on anything – I ponder he will – but I ponder it’s going to be more strategic of exactly what he puts tariffs on. I back that and I feel like his judgement is excellent enough to decide what to tariff.”

Ben Maurer

Ben MaurerLower taxes, cutting spending

What Trump promised:

He has put forward a growth schedule – lower taxes, less regulation and a smaller government, which he says will unleash American business.

What complicates it:

But analysts declare cutting regulation might receive longer than expected. And Trump is widely expected to prioritise extending expiring responsibility cuts above cutting spending.

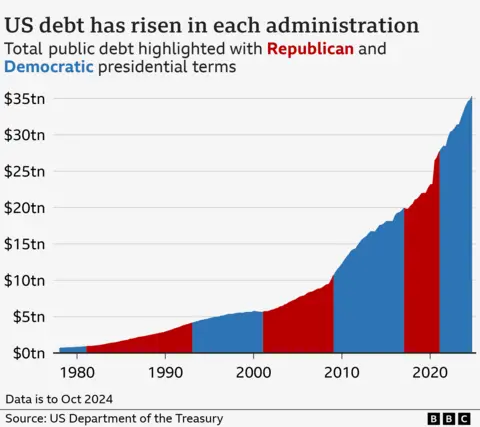

Ms Boccia of the Cato Institute said she expected borrowing to surge under the Trump administration and the rise to add to worth rise pressures.

In financial markets, those concerns have already helped to drive up gain rates on government obligation in recent weeks, she noted.

Though Trump will also face some resistance from those inside his event worried about already high US obligation, Ms Boccia said extending the responsibility cuts – projected to add more than $4.5tn to US obligation over the next decade – seemed all but sure.

By contrast, Trump ruled much of the strategy off limits during his campaign when he promised to leave large programmes, such as Social safety, unchanged.

The so-called Department of Government Efficiency (DOGE) led by Elon Musk and Vivek Ramaswamy has also publicly scaled back its ambitions.

What Trump voters desire:

Mr Maurer said shrinking the bureaucracy was key to his hopes for the administration.

“Government spending is absolute insanity,” he said.

Additional reporting by Ana Faguy