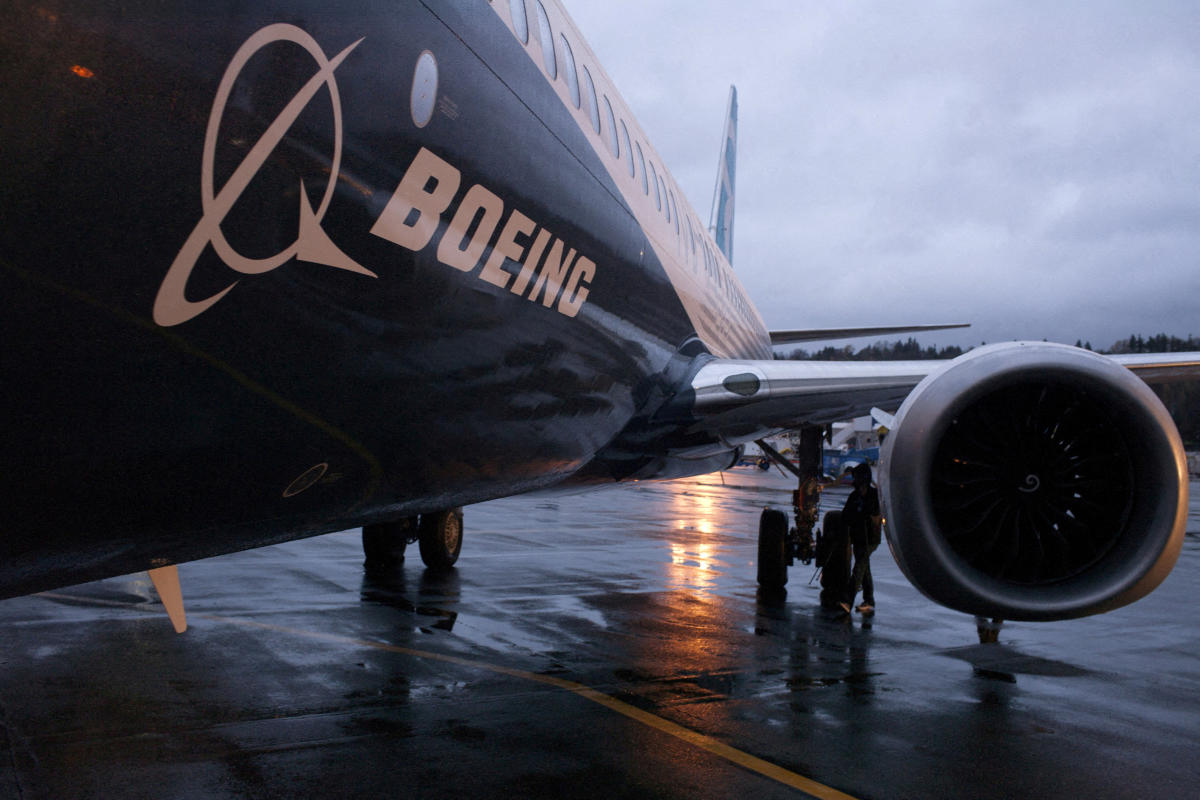

Boeing shores up cash reserves as labor strike, operations costs soar

Boeing (BA) made two big moves late Monday night to shore up its balance sheet as the company faces an extremely difficult time ahead.

First, Boeing entered into an agreement to secure $10 billion in supplemental credit from a consortium of banks led by Bank of America Securities, Citibank, Goldman Sachs, and JPMorgan. Second and more importantly, the company filed a mixed shelf registration with the SEC to offer up to $25 billion in new debt securities, common stock, preferred stock, and other share offerings.

Earlier, the Wall Street Journal reported Boeing would pursue a $10 billion stock offering via the filing, sources said. Boeing said it had $10.3 billion in cash and securities on hand at the end of September.

Boeing shares closed up over 2% on Tuesday.

The new credit agreement and debt and stock offerings come as the company is mired in a labor dispute with its largest labor union and as the company attempts to ramp up production of its commercial jets after a mid-air door blowout of an Alaska Airlines 737 Max jet and numerous instances of whistleblowers claiming production issues with the 787 Dreamliner widebody jet.

On Friday, Boeing released preliminary third quarter financials as the situation at the planemaker was getting more dire. Boeing said it expects to report a GAAP loss per share of $9.97, with operating cash flow of -$1.3 billion. The company will also end production of its 767 tanker jet and push back the release of its upcoming 777X widebody jet.

The company will take $5 billion in pre-tax charges, with $3 billion coming from the commercial airlines division and $2 billion coming from its defense business.

New CEO Kelly Ortberg also announced the company would lay off 10% of its labor force, or around 17,000 employees, across all the divisions to shore up its financial position.

“Our business is in a difficult position, and it is hard to overstate the challenges we face together. Beyond navigating our current environment, restoring our company requires tough decisions and we will have to make structural changes to ensure we can stay competitive and deliver for our customers over the long term,” Ortberg wrote in a memo to employees.

The layoffs, which come as early as next month, will occur as Boeing’s labor dispute with the International Association of Machinists (IAM) enters a second month. After the union voted down an initial proposal, the two sides have been negotiating through a mediator to come to a deal; however an agreement has been elusive.

Currently, both sides are not negotiating, and Boeing revoked its latest offer after the IAM declined to vote on it. The cost of the strike so far has been substantial for both Boeing and the workers, with one trade group estimating the total cost is nearing $5 billion.

“Even if the strike is resolved today, there will be a need for additional liquidity as deliveries will be impacted into 2025,” said Third Bridge analyst Peter McNally in a note to investors. “Despite the strongest quarterly deliveries for the year, Q3 still saw Boeing come up short on cash flow.”

Boeing will have more to say on strike costs and the resulting business effects when it releases full third quarter financial results on Oct. 23.

Pras Subramanian is a reporter for Yahoo Finance. You can follow him on Twitter and on Instagram.

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance

Post Comment