National Insurance: What are NI and turnover responsibility and what do I pay?

National Insurance: What are NI and turnover responsibility and what do I pay?

Getty Images/BBC

Getty Images/BBCAhead of the apportionment on 30 October, the government has confirmed it will not boost the main rates of the two biggest personal taxes – turnover responsibility and National Insurance (NI).

However, the chancellor Rachel Reeves and prime minister Sir Keir Starmer have both hinted that they may put up the rate of NI paid by employers, as they look to fill what they declare is a £22bn “black hole” in the community finances.

The rate of NI paid by workers and the self-employed has been cut in 2024, but previous changes to the way responsibility is calculated cruel the amount many people pay overall has risen.

What is National Insurance and what does it pay for?

The government uses National Insurance contributions (NICs) to pay for benefits and to assist pool the NHS.

It is paid by employees, employers and the self-employed across the UK. Those over the state retirement fund age do not pay it, even if they are working.

Eligibility for some benefits, including the state retirement fund, depends on the NICs you make across your working life.

How much do employers pay in National Insurance?

Businesses pay a rate of 13.8% on employees’ profits above a threshold of £9,100 a year.

Employers also pay Class 1A and 1B National Insurance contributions on costs and benefits they provide to their employees, also at a rate of 13.8%.

Neither employers nor employees pay currently NI on retirement fund contributions, but there is widespread uncertainty-taking that the apportionment will set out plans for employers to commence doing so.

How much do employees pay in National Insurance?

Workers commence paying NI when they turn 16 and earn more than £242 a week, or have self-employed profits of more than £12,570 a year.

The starting rate for National Insurance for 27 million employees fell twice in 2024: from 12% to 10%, and then again to 8%.

The previous Conservative government said that the two cuts were worth about £900 a year for a worker earning £35,000.

For the self-employed, Class 4 NI contributions on all profits between £12,570 and £50,270 fell from 9% to 6%.

At the period, the previous government said this was worth £350 to a self-employed person earning £28,200.

Self-employed workers also no longer have to pay a divide category of NI called Class 2 contributions.

The NI rate on turnover and profits above £50,270 remains at 2% for all workers.

What are the current turnover responsibility rates?

turnover responsibility is paid on profits from employment and profits from self-employment during the responsibility year, which runs from 6 April to 5 April the following year.

It is also paid on some benefits and pensions, turnover from renting out property, and returns from funds and investments above sure limits.

The basic rate is 20% and is paid on annual profits between £12,571 and £50,270.

The higher rate is 40%, and is paid on profits between £50,271 and £125,140.

Once you earn more than £100,000, you also commence losing the £12,570 responsibility-free personal allowance.

You misplace £1 of your personal allowance for every £2 that your turnover goes above £100,000.

Anyone earning more than £125,140 a year no longer has any responsibility-free personal allowance.

The additional rate of turnover responsibility of 45% is paid on all profits above £125,140 a year.

These rates apply in England, Wales and Northern Ireland.

Some turnover responsibility rates are different in Scotland, where a recent 45% band took result in April. The top rate also rose from 47% to 48%.

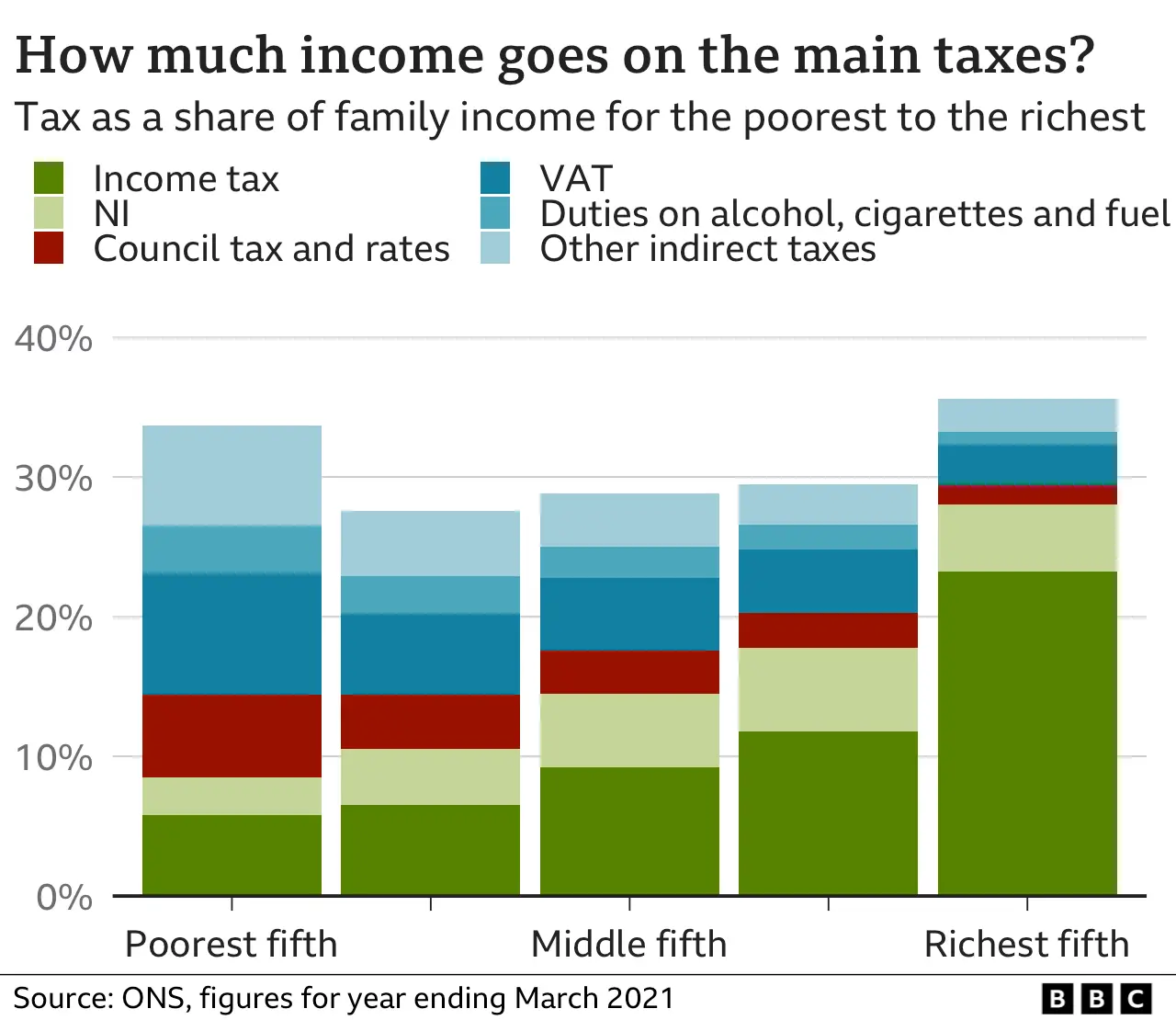

Who pays most in turnover responsibility?

For most families, turnover responsibility is the single biggest responsibility they pay.

But for less well-off households, a greater distribute of household turnover goes on taxes on spending, known as indirect taxes.

For the poorest fifth of households, VAT is the biggest single responsibility paid.

Why are millions paying more responsibility?

Despite the NI cuts in 2024, millions will still pay more responsibility overall because of changes to the responsibility thresholds.

These are the turnover levels at which people commence paying NI or turnover responsibility, or have to pay higher rates.

These used to rise every year in line with worth rise.

However, the NI threshold and responsibility-free personal allowance have been frozen at £12,570 until 2028. Higher-rate responsibility continues to kick in for profits above £50,270.

Freezing the thresholds means that more people commence paying responsibility and NI as their wages boost, and more people pay higher rates.

According to the Institute for financial Studies (IFS) ponder thank, the freeze cancels out the benefits of the NI cuts for some workers.

In the 2024-25 responsibility year, it says an average earner will have a responsibility cut of about £340 – from the combined responsibility changes – and people earning between £26,000 and £60,000 will be better off.

But by 2027, the average earner would be only £140 better off – and only people earning between £32,000 and £55,000 a year would still advantage.

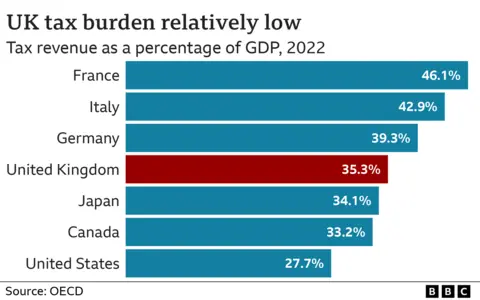

How do UK taxes contrast with other countries like France and Germany?

You can look at the amount of responsibility raised as a proportion of the size of the economy, or GDP.

In 2022 – the most recent year for which international comparisons can be made – that figure was 35.3%.

That puts the UK correct in the middle of the G7 throng of large economies.

France, Italy and Germany responsibility more; Canada, Japan and the US responsibility less.

However, overall taxation in the UK is high compared with historical rates.

In its assessment of the 2024 March apportionment, the OBR said the government would collect 37.1p of every pound generated in the economy in 2028-29.

That would be the highest level in 80 years.

Post Comment