US shares and Bitcoin hit record highs on Trump triumph

US shares and Bitcoin hit record highs on Trump triumph

Getty Images

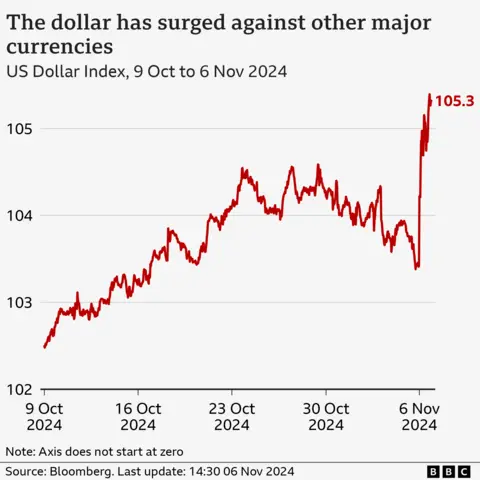

Getty ImagesUS shares hit record highs on Wall Street and the dollar posted its biggest gain in eight years as Donald Trump was re-elected to the White House in a historic triumph.

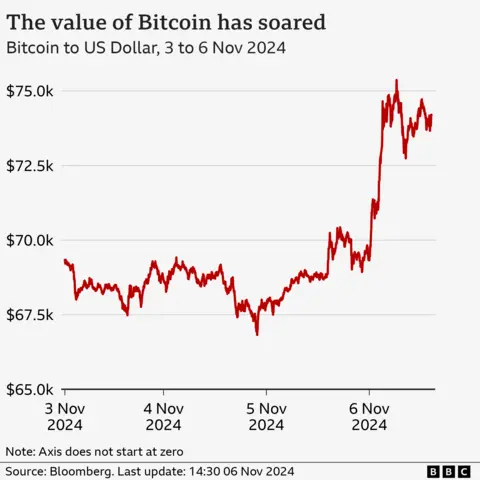

Bitcoin also hit an all-period high, following Trump’s election commitment to prioritise the volatile crypto money.

Investors were, however, betting that Trump’s schedule to cut taxes and raise tariffs will push up expense boost and reduce the pace of gain rate cuts.

Higher rates for longer cruel investors will get better returns on reserves and investments they hold in dollars.

Markets and currencies around the globe shifted sharply on Wednesday following the US election information:

- The major US distribute indexes soared, with banks performing particularly well

- The dollar was up by about 1.65% against a host of different currencies, including the pound, euro and the Japanese yen

- The pound sank 1.16% against the US dollar to its lowest level since August

- The FTSE 100 index, comprising the largest companies listed in the UK, rose in early buying and selling before closing marginally down

- The euro dived 1.89% against the US dollar to its lowest level since June as the German Dax and the French CAC 40 and distribute indexes closed down 1.14% and 0.51% respectively

- In Japan, the point of reference Nikkei 225 distribute index ended the session up by 2.6%

- In mainland China, the Shanghai Composite Index ended 0.1% lower, while Hong Kong’s Hang Seng was down by around 2.23%

Why is Bitcoin going up?

The worth of Bitcoin jumped by more than $6,600 (£5,120) to an all-period high of $75,999.04.

Trump’s stance on crypto stands in stark contrast with that of the Biden administration, which has led a sweeping crackdown on crypto firms.

He pledged to make the US “the bitcoin superpower of the globe”.

During the election campaign, Trump had suggested that he could fire Gary Gensler, the chair of US regulator the stocks and bonds and swap percentage, who has taken legal action against several crypto firms.

Trump also said he plans to put billionaire Elon Musk in fee of an audit of governmental waste.

Mr Musk has long been a proponent of cryptocurrencies and his corporation Tesla famously invested $1.5bn in Bitcoin in 2021, although the worth of the digital money can be very volatile.

Tesla’s shares rallied more than 14% on Wednesday to a two year high. Mr Musk, Tesla’s top shareholder, has supported Trump throughout his electoral campaign.

Experts said there was turbulence elsewhere on financial markets, however, as a response to global uncertainty and Trump’s potential plans for the economy.

US debt safety yields, the profit a government promises to pay buyers of its debts, soared on Wednesday.

A debt safety is essentially an IOU that can be traded in the financial markets and governments often sell bonds to investors when they desire to borrow money.

The moves may recommend that investors ponder borrowing will rise under the recent administration and are demanding a higher profit for their money.

Tariff impact

Some economists have also warned that Trump’s proposals around trade would arrive as a “shock” to countries around the globe, including the eurozone and the UK economy.

Chancellor Rachel Reeves has said the UK would make “powerful representations” to president-elect Donald Trump about the require for free and open global trade.

“The US also benefits from that access to free and open trade with us and other countries around the globe, and it’s what makes us richer as societies, to advantage from that open trade,” she said.

Donald Trump has said he would dramatically boost trade tariffs, especially on China, if he became the next US president.

Ahmet Kaya, loan amount economist for the National Institute of Economic and Social Research (Niesr), also said the UK could be “one of the countries most affected” under such plans.

It estimates that market advancement in the UK would leisurely to 0.4% in 2025, down from a approximate of 1.2%.

Katrina Ell, director of economic research at Moody’s Analytics said: “Trump’s global trade policies are causing particular angst in Asia, given the powerful protectionist platform on which more aggressive tariffs on imports into the US have been pledged.”

Trump’s more isolationist stance on foreign policy has also raised questions about his willingness to defend Taiwan against potential aggression from China.

The self-ruling island is a major producer of computer chips, which are crucial to the technology that drives the global economy.

Investors also have other key issues to focus on this week.

On Thursday, the US Federal savings is due to announce its latest selection on gain rates.

Comments from the head of the central lender, Jerome Powell, will be watched closely around the globe.

North America correspondent Anthony Zurcher makes sense of the race for the White House in his twice-weekly US Election Unspun newsletter. Readers in the UK can sign up here. Those outside the UK can sign up here.

Post Comment