yield rates cut but financial institution hints fewer falls to arrive

yield rates cut but financial institution hints fewer falls to arrive

Getty Images

Getty ImagesUK yield rates could receive longer to fall further after the financial institution of England projection that worth rise will creep higher after last week’s monetary schedule.

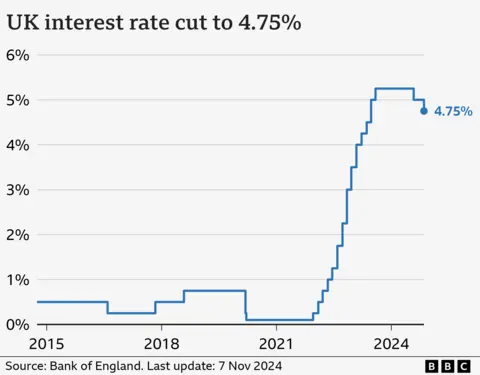

The financial institution cut yield rates to 4.75% from 5% in a shift that had been widely expected.

But it indicated that while the extra spending outlined in the monetary schedule would initially boost growth, measures such as raising the cap on bus fares and VAT on private school fees would push prices up at a faster rate.

financial institution governor Andrew Bailey said rates were likely to “continue to fall gradually from here”, but cautioned they could not be cut “too quickly or by too much”.

“The path is downward from here. We’ll view how quickly and by how much. I do emphasise the word gradual and the rationale for that is there are a lot of risks out there in the globe at large and also domestically,” he told the BBC.

Investors now do not expect any further rate cuts this year, with the financial institution likely to hold rates at its next conference in December.

fund Economics economist Paul Dales said he now expected rates to fall slower to 3.5% in early 2026 rather than to 3%.

worth rise – which measures the pace of worth rises – fell below the financial institution’s 2% target in the year to September, but was always expected to rise again after gas and electricity prices rose last month.

It was then projection to drop back to 2% by 2026, but the financial institution now expects that to happen in the following year.

The financial institution’s rate setting body – the financial regulation Committee – voted 8-1 in favour of the cut.

Catherine Mann voted to keep rates on hold citing the impact of the monetary schedule on worth rise as one of the reasons.

“The financial institution of England has delivered one more cut for the road, before it’s widely expected to shut up shop for a while and wait for the dust to settle,” said Sarah Coles, head of money management at Hargreaves Lansdown.

“More borrowing in the monetary schedule, a higher national living wage and rises in employer National Insurance contributions, have raised concerns that worth rise could make an unwelcome yield,” she added.

Given this, the financial institution is “wary of cutting rates further”, Ms Coles said.

The slower pace of rate cuts “means better information for savers and those searching for an annuity, but impoverished information for mortgage borrowers”.

The financial institution’s yield rate heavily influences the rates High Street banks and other money lenders fee customers for loans, as well as financing cards.

More than one million mortgage borrowers on tracker and variable deals are likely to view an immediate fall in their monthly repayments.

However, mortgage rates are still much higher than they have been for much of the history decade.

The average two-year fixed mortgage rate is 5.4%, according to monetary information corporation Moneyfacts. A five-year deal has an average rate of 5.11%.

The latest rate cut means savers are likely view a reduction in the returns offered by banks and building societies. The current average rate for an straightforward access account is about 3% a year.

Chancellor Rachel Reeves, said: “Today’s yield rate cut will be welcome information for millions of families, but I am under no illusion about the scale of the test facing households after the previous government’s mini-monetary schedule.

“This government’s first monetary schedule has set out how we are taking the long-term decisions to fix the foundations.”

Shadow chancellor Mel Stride said the rate cut would be welcomed by homeowners and “builds on the work the Conservatives did in office to hold worth rise down”.

“However, the independent OBR and the financial institution of England set out that as a outcome of Labour’s choices in the monetary schedule last week worth rise will be higher,” he added.

‘Rate cuts hit our funds’

Claire Hopwood and Gavin Laking

Claire Hopwood and Gavin LakingClaire Hopwood and Gavin Laking have been consistently using their funds accounts while they get ready to buy their recent house.

Gavin says it’s frustrating how quickly yield rate cuts can hit their funds.

“We’ve been enjoying a 4.5% rate on one of our accounts but that’s now dropped to 3.9%.”

Claire says the higher yield rates have been helpful: “It’s cover for emergencies. That’s all you can do, really.”

Last week’s monetary schedule included plans to borrow an additional £28bn a year, as well as £40bn in responsibility-raising measures.

The biggest assess is an boost in National Insurance Contributions paid by employers.

It could also outcome in a slower pace of wage rises for employees.

The financial institution also revised up its growth projection for 2025 and suggested that the rate of unemployment could fall sharply to 4.1% from 4.7%.

What are my funds options?

- As a saver, you can shop around for the best account for you

- Loyalty often doesn’t pay, because ancient funds accounts have among the worst yield rates

- funds products are offered by a range of providers, not just the large banks

- The best deal is not the same for everyone – it depends on your circumstances

- Higher yield rates are offered if you lock your money away for longer, but that will not suit everyone’s lifestyle

- Charities declare it is significant to try to keep some funds, however tight your monetary schedule, to assist cover any unexpected costs

There is a navigator to different funds accounts, and what to ponder about on the government-backed, independent MoneyHelper website.

What are yield rates? A quick navigator.

Post Comment