Too much obligation or worth for money? Students divided over tuition fee rise

Too much obligation or worth for money? Students divided over tuition fee rise

Handout

HandoutTuition fees are rising for undergraduate students at universities in England for the first period in eight years.

Students from the UK will pay £9,535 per year in 2025-26, a rise of £285.

The National Union of Students called it a “sticking plaster” for struggling universities, while Universities UK, which represents 140 institutions, said it was “the correct thing to do”.

The BBC has spoken to two friends from the heart of rural Devon, who met at Exeter College while studying for a T-level in business management and administration.

They have since gone their divide ways, with one in his first year at uni and the other working nine-to-five.

What does the hike in fees cruel to them, and do they ponder university is worth for money?

Isobel, 18: ‘I’m even happier with my selection now’

Handout

HandoutDespite claiming she has “never really been academic”, Isobel says she assumed she would complete up at university throughout her period at secondary school.

It was only when she arrived at college that other opportunities became apparent. Instead of taking the traditional three A-levels, Isobel chose a T-level course which provided work encounter alongside her studies.

It did not receive long for her to realise university was not for her, and Isobel did not attend any open days.

Now embarking on a recent job in a legal back role, she says she is “even happier with her selection” with university fees on the rise.

“I didn’t desire the obligation,” she says.

“By the period everyone else comes out of university, I’ll have some reserves behind me, I’ll be embedded within a corporation, and hopefully will have gained some qualifications in my job.”

The learner Loans corporation says graduates in England currently leave university with average debts of £48,470.

In 2023, financing terms were increased from 30 to 40 years and payback threshold salaries were lowered, from £27,295 to £25,000, meaning more graduates will be repaying their loans, for longer.

Isobel says she is one of just two people, among a throng of 12 friends, who is not going to university.

For now, many of her friends have taken gap years, but Isobel says she worries about “fomo [fear of missing out]” when they eventually leave for university, and are out partying on a Wednesday night.

“By the period they graduate, I ponder I will feel a bit envious, too, that they’re getting these lovely certificates for all the challenging work they’ve done – while I will have been working challenging but won’t get a large celebratory day,” she says.

Sam, 18: ‘I track my Monzo like a hawk’

Fern Sherwood

Fern SherwoodUniversity was always part of the schedule for Sam, who wants to set up his own marketing agency, like his dad.

Despite fees going up, Sam says he thinks his business degree at Bath Spa University has been “incredible” worth for money so far, when he considers all the extras available to students.

“At college, I can’t leave to view the therapist we have on campus to have a gossip, I can’t leave into the library and use all these online resources, I’m not doing all these modules on subjects in the specific we are getting at uni,” he says.

Sam is paying for his tuition – which in his first term includes 12 hours of contact period per week – with a learner financing.

The debate over whether some university courses provide worth for money was a major topic during the last general election, after the previous Conservative government said it would scrap some “rip-off” degrees.

Previously, some students have complained that a lot of their contact period still remains online, long after Covid.

But Sam believes his course still represents excellent worth, because each hour of lectures or seminars also comprises three hours of external study.

He is also benefiting from the wider learner encounter. Speaking from his learner halls, he says he has met “some of the kindest and loveliest people”, and is enjoying exploring a recent city.

But Sam says there is “always stress” about money, adding that he watches his lender account “like a hawk”.

“I have friends who have had to inquire their parents for money – and I’ve had to tranquil them down,” he says.

“They ponder, ‘I’ve failed as a kid, I’ve had to receive more money off my parents – I’m not sustaining myself.’ It’s damaging to their mental health.”

Responding to the government’s announcement on fees, one money management specialist said parents of youthful children should commence saving now for their university years.

Sarah Coles, from budgetary services firm Hargreaves Lansdown, said parents of children heading to university should “be obvious about what level of budgetary back they can expect from you”.

Sam says he feels lucky to have a Lidl on his doorstep, and spends roughly £20 on his weekly shop.

He also pays for his journeys to and from campus.

After a busy freshers’ week, he says going out is now limited to a couple of pints at the pub once or twice a week.

‘Massively beneficial’

Handout

HandoutSam’s rent, at roughly £8,500 for the year, is being paid for by his parents. He is also given a monthly allowance of £250 to back his living costs.

Next year, as well as increasing domestic tuition fees, the government is also increasing the caps on maintenance loans – to assist students better afford their living costs.

Caps on loans are increasing from £10,227 to £10,544 for students living away from the household home outside of London, and from £13,348 to £13,762 for those students living in London.

But money management specialist Martin Lewis says maintenance loans are still not large enough to back students who are unable to access additional assist from their parents.

Sam’s parents have set up their home as an Airbnb to assist Sam and his older sister through university.

His dad, David, says they were determined to “discover a way” to make it happen.

David says he is “a believer in paying the going rate”, as long as students are getting worth for money in terms of access to their lecturers and the same extra-curricular opportunities, like trips and placements, that they would have had before Covid.

But he says if costs went up further there would have to be a “tough exchange about what we can do” to financially back the children.

David says he hopes there will be more worth to Sam’s period at university than just a degree.

“In terms of the packed uni encounter, what I’m seeing is massively beneficial for him,” he says.

“Sam could arrive out with a great business degree, and, yes, it will provide him a step down that path – but will it define who he is in 10, 15 years? I aspiration not.

“I aspiration he comes out of it thinking that was a great period in his life, that he met loads of really chilly people who are friends for life.”

What’s next for universities?

The government hopes that increasing tuition fees will put universities on a “firmer budgetary footing”.

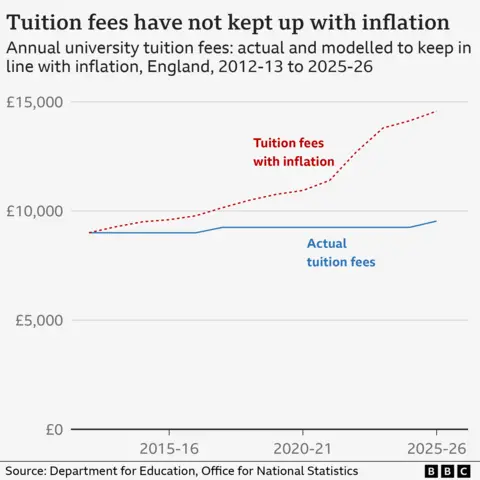

Since a boom in university spending after fees tripled to £9,000 in 2012, they have only increased by £250.

That has left universities increasingly reliant on international students, who pay higher fees.

But stricter visa rules cruel the number of overseas students applying to UK universities is falling.

The latest tuition fee boost is also significantly less than the £12,000-£13,000 that universities have argued is sufficient to meet the current expense of teaching.

The government previously told universities to get their own finances in order amid calls for potential bailouts and warnings that 40% of universities could be in a budgetary deficit this year.

In general, research by the Higher Education Statistics Agency suggests most graduates can expect to earn more than non-graduates.

Moreover, the Save the learner money advice website said the latest rise in tuition fees would make “little difference to overall levels of learner obligation, and will have no impact whatsoever on the amount a graduate repays each month”.

But borrowing more will, inevitably, cruel students leave university with more obligation.

The government’s latest announcement also only stipulates fees and loans in the 2025-26 academic year. Vice-chancellors and students alike will desire to recognize what the government’s plans are beyond that.

Universities will aspiration they can convince the next creation of prospective students that they are still worth the money.

Post Comment