Unemployment rises as pay growth slows again

Unemployment rises as pay growth slows again

Getty Images

Getty ImagesThe UK’s unemployment rate has risen, official figures recommend, while pay growth continues to leisurely.

The rate of unemployment stood at 4.3% in the three months to September, up from 4% the previous quarter.

However, the Office for National Statistics (ONS) urged caution over giving too much weight to its latest jobs figures due to issues with how it gathers the data.

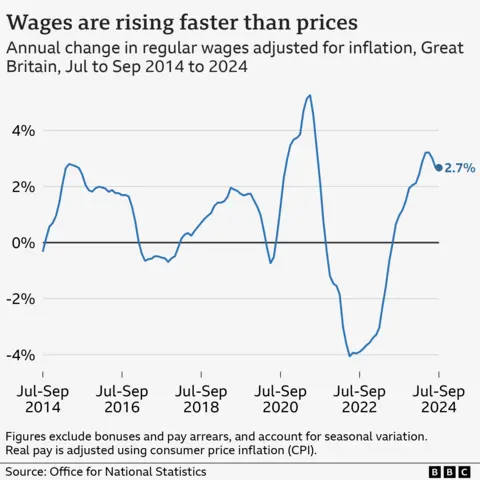

While wage growth has eased, pay is still rising faster than expense boost, which measures the rate of worth increases.

Excluding bonuses, pay grew at an annual rate of 4.8% between July and September – the lowest in more than two years.

The number of vacancies also fell again, as they have been doing for more than two years now.

Liz McKeown, director of economic statistics at the ONS, pointed out that the total still remains a little above pre-pandemic levels.

She told the BBC’s Today programme that the latest figures suggested there was a “continued easing of the labour economy”.

But the ONS’s Labour Force Survey, which produces the data on jobs in the UK, has had a smaller number of respondents over the history year than normal, prompting concerns over its reliability.

The lender of England closely watches the jobs data when making decisions on profit rates.

It cut rates for the second period this year last week, with expense boost below its 2% target at 1.7%.

Ms McKeown said the ONS recognised that issues with its numbers were affecting the central lender, and that it was working to enhance it as quickly as feasible.

The latest ONS figures are supported by anecdotal reports that some businesses, already facing higher costs, paused hiring ahead of the budget.

Supermarkets including Asda and Sainsbury’s and High Street giant Marks and Spencer have said they face a steep rise in costs as a outcome of the hike in National Insurance contributions (NICs) and increases to the minimum wage from April under measures outlined in Chancellor Rachel Reeves’ first budget.

The responsibility rises have led to concerns from businesses that they might have to cut back on hiring, restrict wage increases for staff, or raise prices.

While community sector pay awards granted by the government will feed through to official figures over the rest of the year, economists have warned the forthcoming rise in employers’ NICs could squeeze those in the private sector.

Alexandra Hall-Chen, capital policy adviser for employment at the Institute of Directors, said that the measures in the Employment Rights statement and responsibility rises were “taking a solemn toll on hiring intentions”.

“The cumulative result of these changes will ultimately be to stifle job creation… [the government] needs to urgently address business’ concerns about the increased risks and costs associated with employing staff,” she added.

‘If you desire to retain staff, you require to boost pay’

Wendy Jones-Blackett

Wendy Jones-BlackettWendy Jones-Blackett, from Chapel Allerton, near Leeds, specialises in designing and making handmade greeting cards.

She told the BBC that while her tiny business employs seven workers, companies it sub-contracts for printing and storage would likely be more affected by the government’s budget decisions.

“The thing that we’re having to construct in is that their costs are going to leave up – their services and the things that we buy,” she said.

“It is going to make us question pay rises – if you desire to retain excellent staff, you desire to boost their pay. We desire to do that but we’ll have to temper that with rising costs.”

Another survey by the Recruitment and Employment Confederation and consultancy KPMG recently showed that vacancies fell for the 12th month in a row, suggesting there is less demand for workers.

But Rob Wood, chief UK economist at Pantheon Macroeconomics, said that the lender of England would focus on large trends rather than “tiny data misses” by the ONS when weighing up its next selection around profit rates.

“Unemployment is likely gradually rising, the labour economy is loosening but it remains tight,” he said. “Similarly, wage growth is gradually slowing but remains too high still to deliver expense boost sustainably at target.”

Other economists have said they do not depend the latest figures from the ONS would spur the lender to opt for another rate cut in December.

Work and Pensions Secretary Liz Kendall said that “more needs to be done to enhance living standards”.

The Labour MP said that from April, three million of the lowest-paid workers would advantage from an boost to the minimum wage, known officially as the National Living Wage.

Sign up for our Politics Essential newsletter to read top political analysis, earnings insight from across the UK and remain up to speed with the large moments. It’ll be delivered straight to your inbox every weekday.

Post Comment