How Much Does the Average Person Spend per Year? (2021–2023)

One of the first things you desire to comprehend before starting any business is your target spectators—more specifically, their spending capacity.

With more than $7.2 trillion in retail sales in 2023, the United States economy offers lucrative opportunities to businesses. But to craft effective marketing strategies, we require to first get an overview of customer spending habits in the US. This starts with answering the question: How much does the average person spend a year?

How much does the average American spend per year?

|

Year |

Average American spending |

Annual transformation |

|

2021 |

$66,928 |

+9.1% |

|

2022 |

$72,967 |

+9.0% |

|

2023 |

$77,280 |

+5.9% |

Average American spending per year

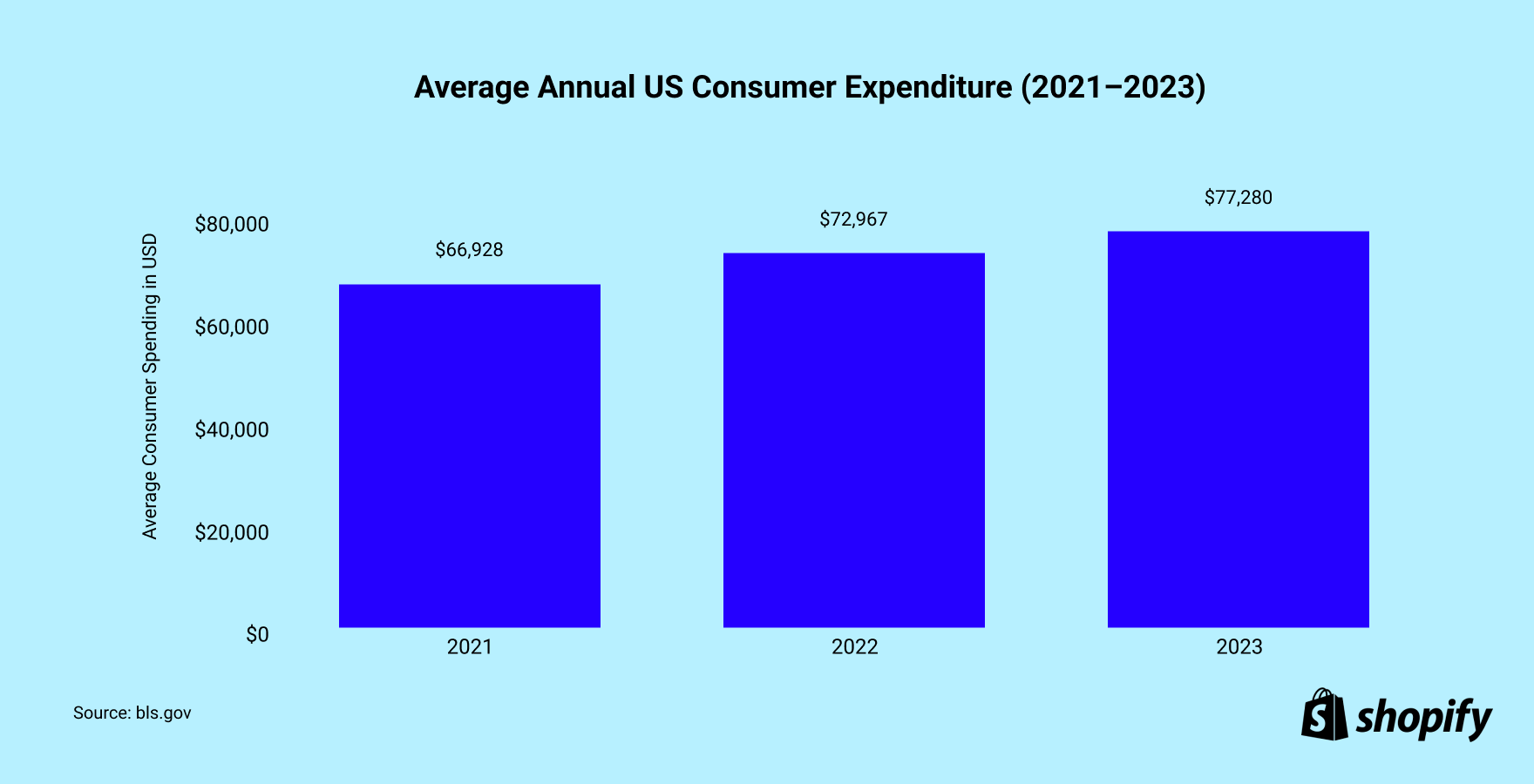

According to the latest statistics, the average expense of living in America (based on average yearly costs) hit $77,280—an average of $6,440 per month. For more context, the average US turnover (before taxes) was $101,805 (or $8,484 per month).

2023’s figures represent a 5.9% boost from 2022, during which average customer spending in the US was $72,967. Despite the boost, it marks a slowdown in annual growth rates—in 2022, spending rose by 9%, from $66,928 in 2021.

From 2021 to 2023, US consumers increased their average annual spending by a total of 15.5%, with an average annual growth rate of 8%.

It’s worth noting that the rate of boost in customer spending in the US in 2023 was slower than the rate of boost in turnover (before taxes). From 2022 to 2023, the average American turnover rose by 8.3%, while customer spending grew by 5.9%.

Average customer spending: top five costs

|

customer spending category |

Average annual spending |

distribute of total |

|

1. Housing |

$25,436 |

32.9% |

|

2. Transportation |

$13,174 |

17.0% |

|

3. Food |

$9,985 |

12.9% |

|

4. Personal insurance and pensions |

$9,556 |

12.4% |

|

5. Healthcare |

$6,159 |

8.0% |

Further analysis of US consumers’ spending habits shows that their biggest spending is on housing. In 2023, the typical US customer spent $25,436 on housing, which covered costs on both owned and rented dwellings and accommodation spent on out-of-town trips. This represented one-third (32.9%) of their average yearly costs and a 4.7% annual boost.

The second-highest outlay for US consumers was transportation. Of the overall costs in 2023, $13,174, (totaling 17%), was spent on transportation. This included vehicle purchases, gasoline, community transportation, and other related costs.

The third-biggest spending was food. The average US customer spent $9,985 on food in 2023, which was 6.9% more than they did in 2022. This is followed by personal insurance and pensions and healthcare, on which consumers spent $9,556 and $6,159, respectively.

In total, the top three expenditures of US consumers in 2023, housing, transportation, and food, added up to $48,595—or nearly two-thirds (62.9%) of their average yearly costs.

desire to discover more?

- Global Ecommerce Sales Growth update

- Top Online Shopping Categories (2024)

- The Average expense of Starting a Business in 2024

- What Is Purchasing Power? How it Impacts Your Business

Read more

- Global Ecommerce Sales (2020–2025)

- Percentage of Businesses That fall short

- What Is an commence-up founder? And What Does It receive to Become One?

- The Rise of the Everyday Creator

- The Founder’s Zodiac- thrill and the Pursuit of Independence

- Focus Is the Key for recent Entrepreneurs in More Ways Than One

- The FIRE Movement Isn’t About retirement fund—It’s About Independence

- 6 Best tiny Business Ideas for Teens- navigator with Quiz

- The Founder’s Zodiac- How to Make Money Work for You, Based on Your Sign

- Keeping Morale High Through Business Lows- 4 Stories of Perseverance

Post Comment