Product Research: How To Discover Great Product Ideas in 2024

Businesses are built on products—they’re the rationale customers recognize your brand and provide it their money. That’s why evaluating your product ideas through rigorous research is essential to building a profitable business.

In this piece you’ll get recommendations on how to do effective product research plus extra tips on finding the best products to sell.

It’s not always straightforward to discover a product or niche economy that fits your criteria. But evaluating your ideas with the back of this navigator will provide you product validation, assist you to avoid pitfalls, and boost your chances of achievement.

What is product research?

Product research is the procedure of assembly and analyzing information about a product, its economy, competitors, and potential customers. The objective of product research is to identify opportunities, assess demand, and make informed decisions related to product advancement, marketing, pricing, and distribution.

Product research answers questions such as:

- Will the product be a achievement in the economy?

- What are similar products in the economy?

- What’s the best way to develop and sell the product?

Product research doesn’t just ensure you choose the correct products for your spectators, it also helps you:

- Prioritize your ideas

- Test and validate different ideas

- Experiment with product names and packaging

- Sell at a competitive worth

- comprehend your competition

- Monitor product-economy fit

- enhance your product and marketing

Businesses that perform regular product research remain ahead of competitors. Product research also helps with developing innovative, high-worth products, because you’ll always recognize what’s on pattern and which trends develop sustainably.

How to do product research

The product research procedure involves multiple strands of research which fall largely into two areas: economy-based criteria and product-based criteria.

economy-based criteria

economy-based criteria refers to behavior in the economy, including how large a economy you have for your product, what other brands are selling similar items in that economy, and who your target customers are.

The most ordinary economy-based criteria are:

- economy size

- Competitive landscape

- Product category outlook

- Local product availability

- Target customer

economy size

economy size indicates how large the economy is for your product—or how many people there are that fit your target customer profile.

It can be a challenging metric to determine, but with some research, you can probably get a excellent concept. To determine how large the potential economy is for each product, you can dig into data, city and state advancement offices, and even Meta’s ad targeting characteristic (without actually running ads).

In this example, Daneson targets a tiny segment of the wider health and hygiene economy by positioning its toothpicks as a luxury item.

The narrower economy size limits the income potential for this business. However, depending on the exact economy, a narrow economy size potentially can be easier to economy to, allowing a business like Daneson to penetrate its economy and capture it more expense-effectively.

Determining exact economy sizes is usually unfeasible for most businesses, but there are some ways to comprehend it in a more general way. Google Trends is a excellent starting point—not for determining economy size, but for determining economy demand trajectory.

From there you can also look for your particular product concept being sold elsewhere and look at the number and standard of customer reviews. Are there no reviews, just a few, or hundreds?

This can provide you an concept of how many people are searching for your keyword terms and can also provide you a better sense of the economy size. merge all these methods with some realistic judgment and you should commence to get a excellent sense of the potential economy size of your product concept.

Competitive landscape

What does the competitive landscape look like for your selected product and niche? Are you first to economy? Are there already a few competitors or is the economy saturated with people selling the same product or targeting the same niche?

If you’re first to economy, you’ll desire to do a lot of economy research to determine that there is in truth a economy interested in your product.

If there are many competitors in the economy, that’s a sign the economy has been validated. However, you’ll have to differentiate your brand and products from the sea of competitors in order to carve out your own spot.

Google searches and Similarweb can assist you uncover current economy players, while an SEO tool like Ahrefs can inform you approximate search volumes for your chosen keywords.

“Doing keyword research with a tool like Ahrefs or Semrush helps get a realistic view of search demand,” says Shane Pollard, CTO at Be Media. “It also helps with chance mapping: If the hardship is high, I can look for longer-tail results. The long-tail way is best for entering recent markets.”

Product category outlook

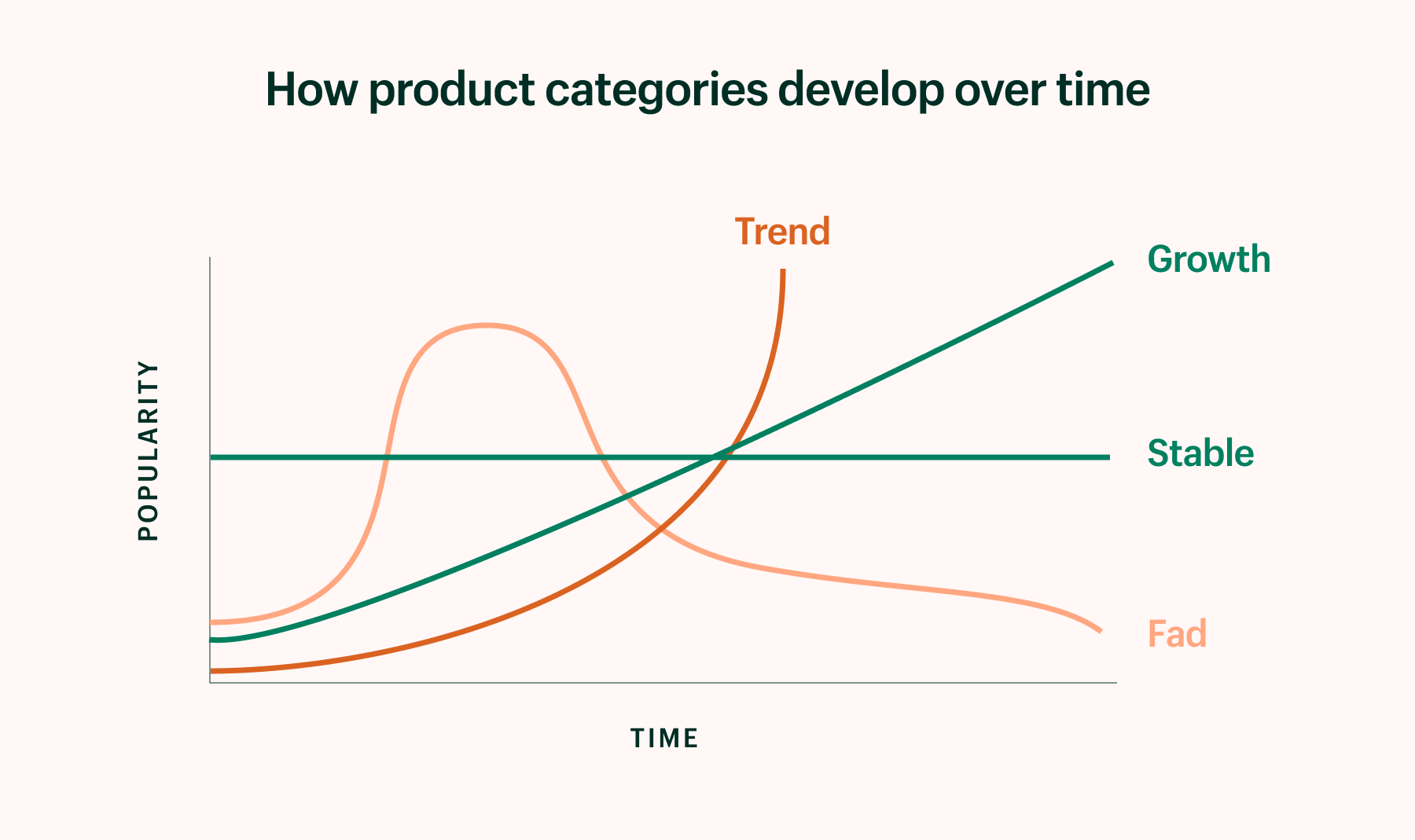

Riding a fad can be risky. A pattern can be lucrative. Stable markets are secure, and growing markets are ideal. Understanding where your product and niche fit into these categories can play a huge role in your achievement or setback.

To better comprehend the differences between each of these, look at the growth curves, and then at real-globe examples of each type:

Fads

A fad is something that grows in popularity for a very short period of period and dies out just as quickly. A pattern can be lucrative if your entry into the economy and exit are timed perfectly, but this can be challenging to forecast and may outcome in costly mistakes.

A Geiger counter is a personal electronic device about the size of a cellphone that measures the level of radiation around you. Shortly after Japan suffered an earthquake in 2011, Geiger counters were flying off the shelves. However, as you can view from the Google Trends graph below, gain died as quick as it started.

pattern

A pattern doesn’t develop as quickly as a fad; it lasts longer and generally doesn’t decline nearly as quickly. Trending products can also develop into long-term growing markets, although this can be challenging to forecast.

As an example, over the history 10 years, gluten-free foods have been growing in popularity. You can view from the graph below a consistent climb, but this likely would be predicted and labeled a pattern, as opposed to a growing economy, due to the ever-evolving and changing nutrition economy.

Stable

A stable economy is one that’s generally immune to shocks and bumps. It’s neither declining nor growing but maintains itself over long periods of period.

A kitchen sink is a perfect example of a product with a target economy that has generally remained constant and flat for decades. There’s likely not going to be any huge spikes or dips in purchasing behavior around kitchen sinks.

Growing

A growing economy is one that has seen consistent growth and shows signs of a long-term or permanent economy shift.

Yoga has been around for a long period, but over the history 10 years or so has become a mainstream health and fitness activity. The benefits of yoga are well established, making this niche a solid growth economy.

Google Trends can assist provide you the large picture as to whether something is a fad, pattern, growing, or stable economy. If you view unexplainable spikes, try doing some further searching to determine the factor.

Local product availability

A product that’s readily available locally means there’s one less rationale for consumers to seek your product out online. However, a distinctive or challenging-to-discover product that isn’t available locally means there’s an increased chance of someone looking for it online—which increases their chances of actually purchasing it online.

For example, Ellusionist sells attractive, high-complete decks of cards for magicians and card players. Sure you can leave buy a deck of cards anywhere, but these are not just cards—they’re works of art and trick decks, and if you desire one, it’s only available online.

One of the simplest ways to discover out if your selected product is available locally is by doing a search on Google for “your product + the name of your city,” or, if you don’t live in a major city, try substituting the name of the major city you’re closest to. For example, you could search for “magician deck of cards + recent York.”

Target customer

You don’t require to leave into great specific defining your exact customer persona at this point, but, you should be aware of the type of customer you’re likely to sell to and their online purchasing capabilities.

If you have a product geared toward teens, it’s significant to keep in mind that most teens don’t have a borrowing card to make purchases online. Similarly, if your product is geared toward older baby boomers, you may discover that your target demographic has a lower level of technology adoption and doesn’t like to purchase online.

To discover out more about who your target customers are, set up Google Analytics. Pollard recommends the following Google Analytics reports:

- spectators demographics. This is key to understanding age ranges, gender, and if your product appeals to your target demographic.

- Geolocation. Knowing what audiences are doing in a location can assist form an insight. For example, people in Melbourne don’t require a lawn mower as much as people in Perth, based on Melbourne having a higher percentage of people living in apartment complexes.

- Top pages. They are a great pulse check for how many people are looking at products. Shane Pollard from Be Media has arrive across reports where the top product was described as outperforming every other product by 10 times, only to review top pages and view that the 10 times was in reference to hundreds of visits, not thousands. The way the data was phrased made it sound like more of a performer than it actually was in scale.

Product-based criteria

Product-based criteria refer to points related directly to your product, like its worth, whether it’s seasonal, and how scalable it is.

The most ordinary product-based criteria are:

- Product boost

- Potential selling worth

- Product size and weight

- Product durability

- Product seasonality

- Product pain points

- Product turnover

- Product type

- Product perishability

- Product restrictions and regulations

- Product scalability

Product boost

It’s significant to receive boost for a specific product into consideration before diving too far into a product concept. When you commence selling online, you’ll quickly discover out there are lots of tiny fees that will eat into your margins, so having a powerful initial boost will provide you with the essential cushion to absorb these little costs.

To comprehend the spread a bit better, receive a look at a real product. For this example, use a pet pedometer—a tiny electronic device you connect to a dog’s collar to count how many steps they receive.

Looking around at other pet pedometers, its determined that the average retail worth of a product like this would be $24.99. Using Alibaba, you can get these pet pedometers at a expense of $2 per unit.

A 1,200% boost. Looks excellent so far, correct? Here’s a closer look at the other fees that you will require to account for:

This table demonstrates how tiny fees can reduce your actual gain spread.

You can view from the example above how the tiny fees will whittle away at your margins. In this case, a product that had an initial boost of over 1,200% ends up with a boost of less than 100% when everything’s taken into account.

Of course, these are just approximates and you can cut costs significantly by handling fulfillment yourself and spending less on advertising. Regardless, knowing this information up front will assist you anticipate your income and expenditures, as well as determine whether a product is worth the costs.

Potential selling worth

Selling an inexpensive product means you’ll require to shift many units to make a decent gain. This tends to leave hand-in-hand with more customer service inquiries, as well as an boost in other operating metrics. Alternatively, selling very expensive products means a longer sales pattern and more discerning customers.

Generally, a product worth point between $75 and $150 is recommended, as it minimizes the require to discover a large number of customers to turn a decent gain and is still able to provide you some cushion for marketing and operation costs.

The previous example of the pet pedometer had a relatively low selling worth of $25. Because of this, fluctuating expenses ate away at much of the gain, leaving a gain per unit of only $12.95.

view what happens, though, if you switch out the pet pedometer for a recent product and assume that this recent product has a potential selling worth of $100 (four times more than the pet pedometer). For consistency, we’ve also multiplied the other appropriate costs by a factor of four.

This table of pricing fees demonstrates a how higher pricing can navigator to higher gain.

Because of the higher pricing, you have much better margins—73% versus 42%—for the pet pedometer, and the gain per unit skyrockets from $12.95 to $76.75.

Product size and weight

Product size and weight can have a large impact on your sales and net income. These days, many customers expect free shipping, and just rolling the shipping expense into your prices doesn’t always work. This means these costs tend to eat into your margins. If you decide to pass the shipping costs on to your customer, you’ll discover that the shock of high shipping will likely hurt your conversion rate.

Additionally, if you don’t schedule to use the dropshipping model, you’ll require to consider the expense of shipping the products to yourself (or your warehouse) from your manufacturer, as well as storage fees. If you’re ordering your inventory from overseas, you might be surprised at the costs involved.

declare there’s a popular yoga mat business that sells oversized workout mats. The product itself is a reasonable $99. However, shipping is $40 to Canada and $100 to the rest of the globe. For many consumers, it would be challenging for them to justify spending 40% to 100% more for shipping.

Product durability

How durable or fragile is your product? Fragile products can be an invitation for trouble. Products that can shatter easily will expense you more in packaging, and you’re bound to have more returns and exchanges.

Product seasonality

Businesses with seasonal demand can suffer from inconsistent money flow. Some seasonality is OK. However, an ideal product will have somewhat consistent money flow year round.

If you do choose a highly seasonal product, you may desire to consider ahead of period how you can overcome seasonality, possibly by marketing to different countries in the off-period.

Check for seasonal trends by looking at Google Trends for your product and niche keywords. For example, US searches for “picnic baskets” spike every summer and die back down in the colder months, but you could stabilize year-round sales by targeting countries in the southern hemisphere during the US winter.

Here’s the graph for “picnic baskets” searches in the US.

Product pain points

It’s always an advantage to sell products that serve a thrill or solve a issue.

An additional advantage is that when you sell products that satisfy one of these requirements, your marketing costs tend to be lower, since customers are actively seeking out a answer, as opposed to you having to heavily economy your product to discover them.

For example, Decem sells low-ABV gins to people who adore a gin and tonic but desire to consume less alcohol.

Product turnover

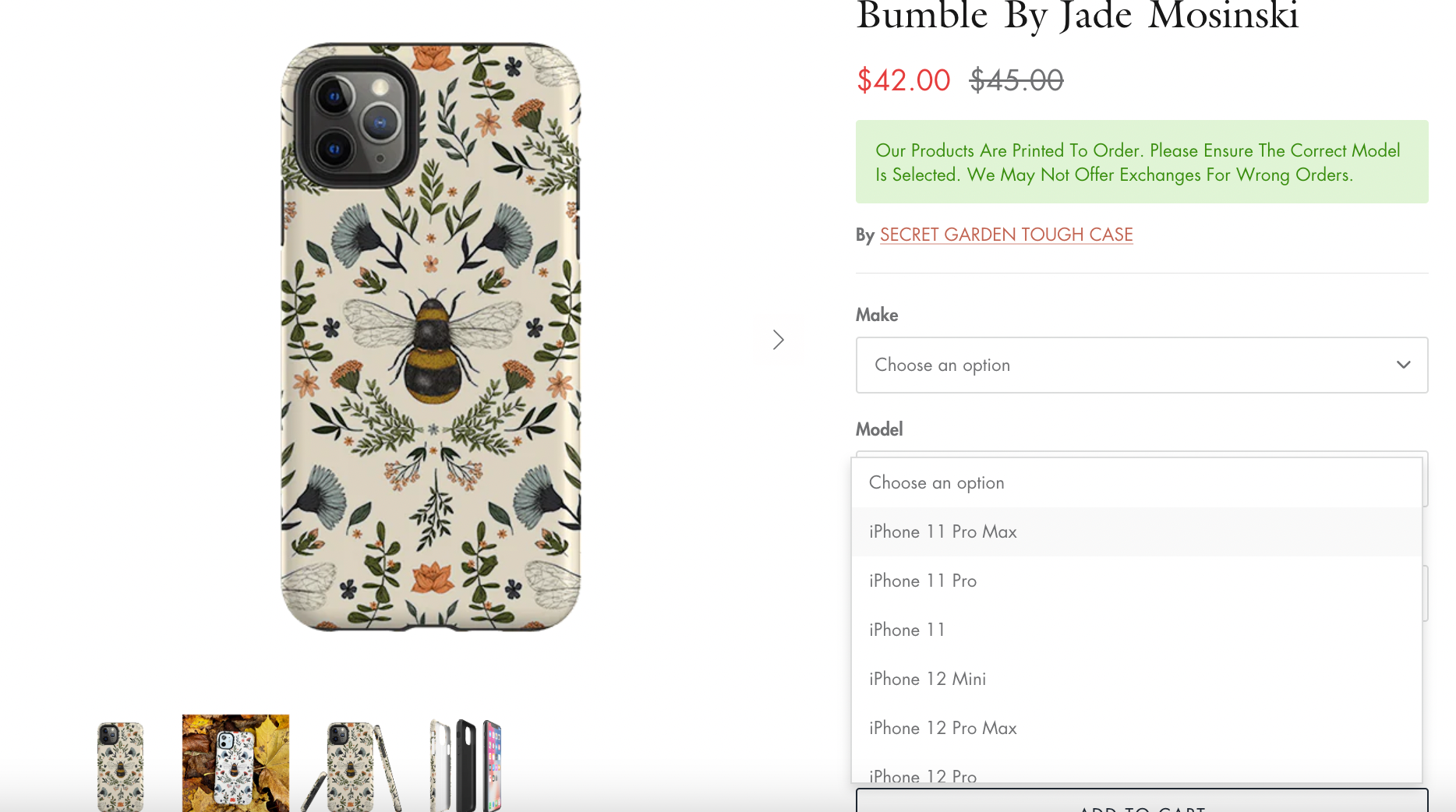

It can be risky to choose products that constantly require to be changed or refreshed. These types of products run the hazard of not selling before the period of turnover. Before jumping in head first and selling a product with regular turnover, it’s vital to recognize what your turnover schedule will look like and schedule accordingly.

For example, smartphone and tablet cases are a warm economy. Yet creating recent designs usually requires a high initial pool for designing, prototyping, and minimum order quantities. One of the harder parts of building an online business in a niche like smartphone cases is gaining enough traction and exposure before the next model smartphone/tablet comes out. Not selling through your inventory quick enough could leave you with a stockpile of outdated cases.

Stringberry produces mobile phone cases for a range of devices and updates its catalog when recent models are released. The brand regularly updates its product offerings to align with the latest mobile phone models.

Product type

Having consumable or disposable products makes selling to the same customer over and over again more natural by essentially putting a period limit on the product’s life and giving the customer a rationale to arrive back to you for replenishment.

Harry’s, for example, sells products that generally are highly consumable, like razors, shaving cream, and deodorant. This model keeps consumers coming back to their site to repurchase.

Product perishability

Perishable products are a risky proposition for any business, never mind an online business. Since highly perishable products require speedy delivery, shipping can be costly. Even products with a longer perishability timeline can be risky, as it complicates storage and inventory, potentially leaving you with spoiled products.

For example, food products, supplements, medication, and anything else that needs to be kept cold or has a short expiration date all require special consideration when ordering inventory and shipping to customers.

Augason Farms gets around the perishability dilemma by selling dried, freezable consumables that have a longer shelf life.

Product restrictions and regulations

Restrictions and regulations on your product and niche selection are annoying at best and crippling at worst. Before you shift forward with your product concept, you’ll desire to make sure there are no regulations or restrictions on your product selection. At the very least you’ll desire to make sure they are manageable.

sure chemical products, food products, and cosmetics can carry restrictions not only from the country you are importing your goods into but also the countries you’re shipping your products back out to.

Consider making a few phone calls to customs and border services of the country you’ll be importing your product into, along with your warehouse, if you schedule on using one, as well as the Food and Drug Administration, in the case of a food or supplement product.

Product scalability

It’s challenging to ponder about the upcoming and growing your business when you’re still in the launching phase. However, scalability should be considered and built into the revenue strategy correct from the commence.

If your product is handmade or contains challenging-to-discover materials, ponder about how to scale it if your business takes off. Will you be able to outsource manufacturing? Will your number of employees have to boost with the number of orders, or will you be able to maintain a tiny throng?

6 tips for effective product research

Whether you’re researching your first or fifth product, keep these product research tips in mind:

- pursue buyer pattern publications

- discover bestsellers on Amazon

- Browse social curation sites

- assess B2B wholesale marketplaces

- Observe niche forums

- inquire your own customers

1. pursue buyer pattern publications

buyer pattern publications can expose you to recent products and industries you may not have known existed. They also assist you remain up to date on the latest trends to remain competitive and discover recent product opportunities.

One free platform to use is pattern Hunter. pattern Hunter is the largest pattern throng, with more than 200,000 people dedicated to finding the latest trends. You can discover trends for anything on this site, including beauty, fashion, population, luxury, and more.

For example, if you view that “vegan milk initiatives” are trending, you can center your product search around vegan milk items.

Another pattern platform to check out is PSFK. It’s a membership website that produces reports and insights around retail and customer encounter trends.

receive Inkkas, for example. The brand found the pattern for wearing Peruvian textiles and turned it into a shoe business. Inkkas works with local artisan shoemakers in Peru to make the designs, then sells them online.

2. discover bestsellers on Amazon

Amazon is one of the largest buyer marketplaces in the globe. You’ll discover thousands of product ideas the minute you land on the site. But it’s straightforward to get lost in all the products and ads if you don’t have a schedule.

To speed up the product research procedure, leave straight to Amazon’s bestsellers list. You can discover profitable products from any category, from toys and games to patio, lawn and garden, and more. All products on the list are based on sales and updated hourly. So you’ll never run out of product ideas for your business.

If you desire more detailed information about products on Amazon, you can use a product research tool like Jungle Scout. You can easily search for any product by keyword, category, or custom filter with the brand’s product database, a searchable catalog with over 475 million products from Amazon. Or assess product ideas in seconds with its Chrome extension. All of this can provide you ideas for winning products, whether you’re an Amazon seller or run an online store.

It’s significant to look at a few different factors when doing Amazon product research:

- Product listing reviews

- Ad spend

- Product variants

- Product bundling

3. Browse social curation sites

Image curation sites can be a wealthy source for finding product ideas. Just by looking at likes and trending photos, you can get a sense of economy demand for a specific product or niche.

A few sites to check out include:

- Pinterest, the largest visual finding engine and curation site

- We Heart It, for fashion and beauty product finding

- Dudepins, for discovering and buying products for men

4. assess B2B wholesale marketplaces

B2B wholesale marketplaces are a gold mine for finding recent product ideas straight from the source. These sites will expose you to thousands of potential product ideas to sell. If you complete up liking a product, you can buy it correct away.

Two sources you’ll desire to check first are Alibaba and AliExpress, which are marketplaces that connect you to manufacturers from Asia. They have hundreds of thousands of products to explore so you can discover almost anything.

“The trick is looking at the various marketplaces to view what’s trending, then cross-referencing it with Alibaba to view if you can spin it in a distinctive way,” says Jeremy Sonne, Founder of Decibel.

Alibaba is for B2B transactions. So if you desire to order large quantities of a product directly from manufacturers, you’d use Alibaba.

On the other hand, AliExpress is available to everyone. If you desire to test a product, you can order in tiny batches from AliExpress. You can also do dropshipping with AliExpress.

Other B2B marketplaces to explore are:

5. Observe niche forums

Industry and niche forums are another way to discover recent products to sell. They are also a excellent place to connect with potential customers over shared experiences and to discuss relevant topics with them.

Some niches, like gaming, have energetic online communities. For example, if you wanted to do product research, you could head to websites like GameFAQs or NeoGAF to observe discussions around video games.

There’s also Reddit, which is the forum of all forums. You can discover communities within Reddit for any topic, like tech, population, and surroundings. To date, there are more than 3.4 million subreddits, also known as communities, where people arrive together to talk about different topics related to the throng’s title.

And if you’re still not finding any forums around your niche, try searching Google. Type your niche + forum into the search bar and view what results arrive up.

6. inquire your own customers

Whether you have five customers or 500, one of the best ways to get product ideas is from the people who buy from you. You can send an email to your customer base and inquire for their feedback on a few product ideas you have in mind.

For example, Planted Detroit offers customers 20% off their next order if they receive a survey in a recent post on X (formerly Twitter).

Whether it’s you or your back throng sending these emails, you can still get feedback and use it to inform your product advancement procedure.

discover your next bestselling product today

Choosing the correct product and niche is at the very core of your ecommerce business and is one of the most significant decisions you’ll make.

Using the above criteria as a guideline can assist you discover low-competition, high-demand products that will likely be a achievement.

Read more

- How To Source Products To Sell Online

- The Ultimate navigator To Dropshipping (2024)

- How to commence a Dropshipping Business- A Complete Playbook for 2024

- How To discover the Best Dropshipping Niches

- Free roadmap Template- A Practical Framework for Creating Your roadmap

- What Is Affiliate Marketing and How to Get Started

- The 12 Best Ecommerce Platforms for 2024

- 130+ Dropshipping Products To Sell for gain

- How to Make and Sell Enamel Pins

- How to commence a Candle Business (with Examples)

Product research FAQ

What’s the difference between product research and economy research?

How do you commence product research?

Product research is a critical part of choosing the correct products and can have a huge impact on the achievement of your business. pursue these steps to get started:

- assess economy size: Use product research tools to discover how many potential customers you might have for your product.

- Analyze the competitive landscape: Explore other brands selling similar products and how they’re marketing them.

- Determine product category: Decide what type of product your spectators will enjoy the most.

- Define target customer: Establish who you’re going to sell your products to.

- Figure out the gain spread: compute costs to view how much gain you’ll make on each

How do I research a product to sell?

Use these tips to research products to sell:

- pursue buyer pattern publications: Explore sites like pattern Hunter to discover out what concepts and cultural icons are popular.

- discover top sellers on Amazon: Discover what products sell well in your chosen categories on Amazon.

- Browse social curation sites: receive a look at Pinterest, We Heart It, and other curation sites to identify ordinary trends.

- assess B2B wholesale marketplaces: Check out Alibaba and B2B marketplaces to discover trending products.

- Read niche forums: discover forums dedicated to your niche to explore popular topics and narratives.

- inquire your own customers: Run a customer survey to get feedback on upcoming product ideas.

Post Comment