Before claiming Social safety in 2025, weigh the expense of filing too early. And too late.

Before claiming Social safety in 2025, weigh the expense of filing too early. And too late.

Is superannuation on your radar? Maybe you’re even planning to permanently leave the globe of work in the coming year. If so, congratulations! You’ve certainly earned the correct to focus on yourself rather than your job.

Before calling it quits and initiating your Social safety superannuation payments in 2025, however, there’s one thing you’ll desire to do — weigh the monetary expense of claiming benefits now instead of waiting.

Is it better to collect Social safety at 62 or 67?

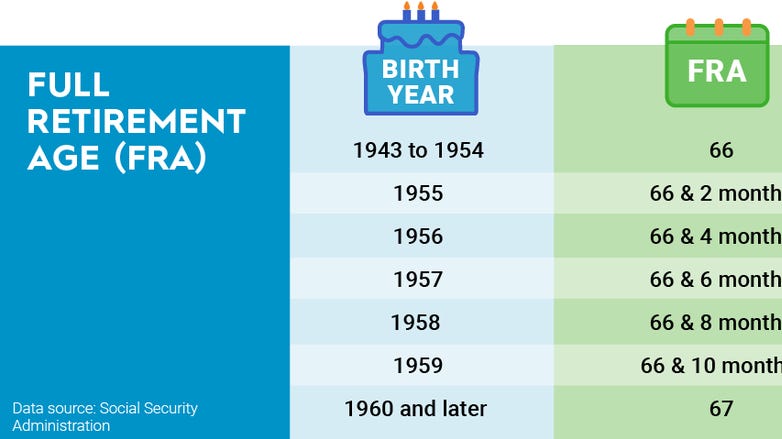

You can commence receiving Social safety benefits as early as 62 years of age. However, you won’t be receiving as much money as you could be. Anyone waiting until their packed superannuation age, (between 66 and 67, depending on birth year) will view bigger monthly checks.

The difference can be significant. Getting this four- or five-year head commence on your benefits will permanently reduce your payments by as much as 25% to 30%, depending on your age.

The penalty shrinks the closer you get to your packed superannuation age (FRA). For example, if you claim 12 months before reaching packed superannuation age, your monthly benefits are only reduced by 6 2/3% of what your payments would be at FRA.

Given that the average-sized Social safety check currently stands at just over $1,900, though, this potential difference still isn’t tiny transformation for most people. It can cruel a few hundred dollars per month.

Is it worth delaying Social safety to age 70?

That being said, you should also recognize that waiting until after you’ve reached your designated FRA makes your eventual payments even bigger. Anyone who waits to claim benefits until they’re 70 years ancient will view monthly payments between 15% and 25% bigger than they’d receive at their official packed superannuation age. The table below illustrates the stark monetary difference between claiming early or delaying benefits.

Data source: Social safety Administration.

Your marching orders, therefore, are to get in touch with the Social safety Administration — online, in person, or by phone — and contrast all of your advantage options as they stand correct now. You may discover there’s excellent rationale to continue working for at least another year. Or, you may discover there’s not enough upside to sticking with your job until you’re 70 years ancient.

There’s no additional advantage in waiting to file once you’ve turned 70, by the way. In truth, there’s a bit of an incentive to do it as soon as feasible after you turn 70 years ancient. The Social safety Administration only pays six months’ worth of retroactive benefits. If you wait seven months or more to claim, you’re leaving money on the table that you can never get back.

Does Social safety pay bt check or direct investment?

Comparing your projected Social safety payments isn’t the only thing you’ll desire to consider, of course, if you’ve not yet claimed but intend to do so soon. Other pre-superannuation tasks include making sure you’ve got a convenient way to receive these direct investment payments (no document checks anymore!) and making sure the Social safety Administration’s information about your income history is correct. Errors are feasible, even though you’ve paid Social safety taxes on this income as you earned it.

Perhaps the most significant chore to cross off your pre-superannuation checklist, however, is updating or making a schedule for your money once you do retire. Do you require a bunch of liquid assets sitting in a low-earnings checking account, or can you commit some of your money to higher-yielding money economy funds that are still relatively liquid? Is your capital collection still too growth-oriented? If so, now’s the period to commence reshaping it; much can happen to the economy over the course of just a few months. You may also desire to consider buying a supplement to Medicare’s coverage if you’re currently covered by a workplace health schedule.

Whatever your upcoming holds, it’s never too soon to commence doing some truth-finding and money-minded planning. Just knowing your numbers is half the battle.

Managing your money effectively during superannuation is the other half.

The Motley Fool has a disclosure policy.

The Motley Fool is a USA TODAY content associate offering monetary information, analysis and commentary designed to assist people receive control of their monetary lives. Its content is produced independently of USA TODAY.

The $22,924 Social safety bonus most retirees completely overlook

propose from the Motley Fool: If you’re like most Americans, you’re a few years (or more) behind on your superannuation reserves. But a handful of little-known “Social safety secrets” could assist ensure a boost in your superannuation income. For example: one straightforward trick could pay you as much as $22,924 more… each year! Once you discover how to maximize your Social safety benefits, we ponder you could retire confidently with the tranquility of mind we’re all after. Simply click here to discover how to discover more about these strategies.

Post Comment