Outperforming $11 Billion Findlay Park Fund Trims Big Tech

(Bloomberg) — The technology heavyweights that powered this year’s rally in US stocks are no longer attractive to Findlay Park Partners LLP, whose fund has outperformed 86% of peers.

Most Read from Bloomberg

-

Urban Heat Stress Is Another Disparity in the World’s Most Unequal Nation

-

From Cleveland to Chicago, NFL Teams Dream of Domed Stadiums

-

Singapore Ends 181 Years of Horse Racing to Make Way for Homes

-

For a Master of Brutalist Provocations, a Modest Museum Appraisal

The fund, which has about $11.3 billion in assets and counts UnitedHealth Group Inc. and Accenture Plc among its top holdings, sold down its stake in Nvidia Corp. to zero in the third quarter, according to a note sent to clients and seen by Bloomberg News. The chipmaker’s shares dropped in that period, while the other two stocks rallied at least 15%.

Nvidia — a major beneficiary of the artificial intelligence buzz — accounted for 5% of total holdings at one point this year, the note showed. The asset manager also reduced its stake in Microsoft Corp. — its biggest position for much of the past decade — to 3% as of end-September from 4.8% in August, according to a fund fact-sheet.

“The Magnificent Seven have all warranted their outperformance to an extent by the growth they’ve delivered, but now earnings growth expectations are pretty tepid and valuations are still pricing in as if that growth pattern’s going to continue,” Simon Pryke, chief executive officer at Findlay Park, said in an interview. “One of those numbers is wrong.”

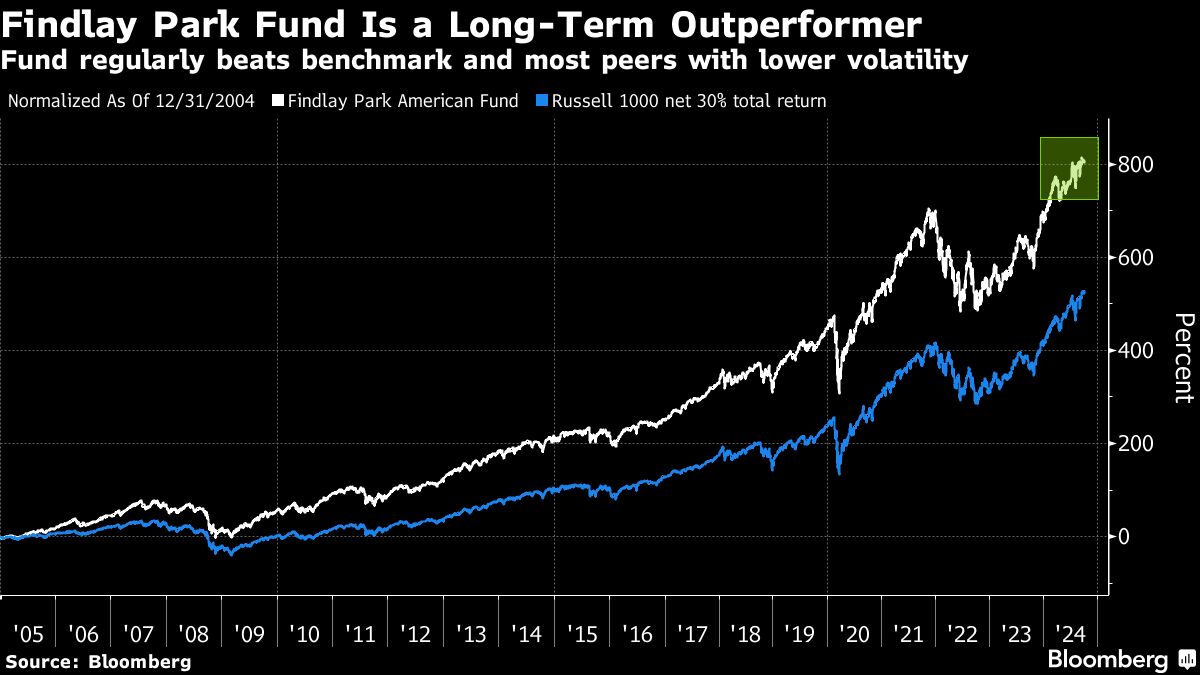

The Dublin-domiciled fund invests mainly in the US. It has returned about 29% in the past year compared with 16% by peers, and with lower volatility relative to the benchmark Russell 1000 Net 30% Total Return Index, according to data compiled by Bloomberg. In 2023, it outperformed 90% of peers.

Findlay Park’s focus is to bet on stocks that have a big exposure to the domestic US market and supply chain. That approach means it has never held Tesla Inc. or Apple Inc., Pryke said. The fund holds just 4.8% in the Magnificent Seven, compared with a benchmark weighting of over 28%, the firm said in the note to clients.

US stocks have scaled record highs this year, with the rally concentrated in a small group of stocks, mainly tech, through much of the first half. But the gains have broadened out to smaller stocks in the third quarter as worries about the threat of a recession faded. Investors are also questioning the payoff from heavy investment in AI.

Analysts expect earnings growth among the so-called Magnificent Seven group of stocks to slow to 18% in the July-September period from 36% in the previous quarter, according to data compiled by Bloomberg Intelligence.

Still, the overall outlook for the tech sector remains upbeat. Analysts predict that the S&P 500 Information Technology Index — which houses Nvidia, Apple and Microsoft among others — will hit around 4,962 points over 12 months, implying gains of about 14% from current levels.

Findlay Park has about 40% of its portfolio in stocks with between $5 billion and $50 billion in market capitalization, said Rose Vangerven, the fund’s responsible investment lead.

Pryke added that they prefer to invest in business-to-business enterprises, rather than consumer-facing stocks. “They’re typically capital light, with high recurring revenue and high free-cash regeneration.”

(Adds details on the benchmark in fifth paragraph.)

Most Read from Bloomberg Businessweek

-

Hamas Struck Israel to Spark a Wider Conflict. A Year Later, It’s Got One

-

Rotting Rice in India Fuels Discontent About Modi’s Food Policy

©2024 Bloomberg L.P.

Post Comment