What next for Bitcoin after bursting $100k barrier?

What next for Bitcoin after bursting $100k barrier?

Getty Images

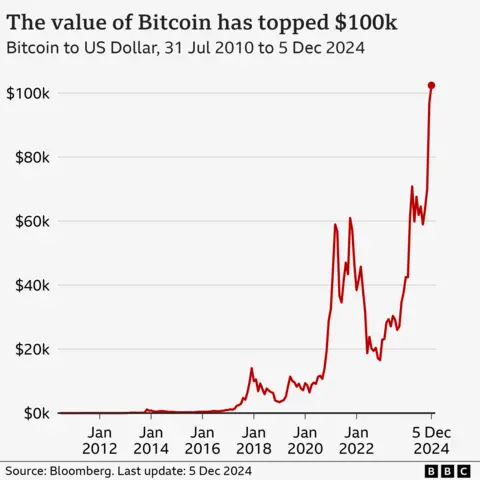

Getty ImagesBitcoin’s worth has blasted through the much-anticipated threshold of $100,000, raising questions about how much higher it could leave – and whether it can shake off its notorious volatility.

The globe’s largest cryptocurrency rose to around $103,400 shortly after 04:00 GMT on Thursday, before falling slightly.

Dan Coatsworth, resource analyst at AJ Bell, described it as a “magic instant” for the cryptocurrency and said it had a “obvious link” to Donald Trump’s election win.

Trump took to social media to celebrate the milestone, posting “congratulations Bitcoiners” and “you’re welcome!”

The president-elect had previously pledged to make the US the “crypto pool” and “Bitcoin superpower” of the globe, helping to push Bitcoin’s worth higher once he was elected president.

It broke through the $100k barrier after Trump said he would nominate former stocks and bonds and swap percentage (SEC) commissioner Paul Atkins to run the Wall Street regulator.

Mr Atkins is seen as being far more pro-cryptocurrency than the current head, Gary Gensler.

“Clearly there is expectation that the recent administration is going to be somewhat more favourable to crypto than the ancient administration was,” said Andrew O’Neill, digital assets specialist at S&P Global.

“So for the worth of Bitcoin, I ponder that that’s what’s driven the pattern so far [and it will] likely continue into the recent year,” he added.

However, Bitcoin has a history of sharp falls as well as rapid rises – and some analysts have cautioned that is unlikely to transformation.

“A lot of people have got wealthy from the cryptocurrency soaring in worth this year, but this high-hazard resource isn’t suitable for everyone,” said Mr Coatsworth.

“It’s volatile, unpredictable and is driven by hazard-taking, none of which makes for a sleep-at-night resource.”

The Trump result

During the US presidential election campaign, Trump sought to appeal to cryptocurrency investors with a commitment to sack Gary Gensler – chair of the US monetary regulator the stocks and bonds and swap percentage (SEC) – on “day one” of his presidency.

Mr Gensler’s way to the cryptocurrency sector has been decidedly less amiable than Trump’s.

He told the BBC in September it was an industry “rife with fraud and hucksters and grifters”.

Under his leadership, the SEC brought a record 46 crypto-related enforcement actions against firms in 2023.

Mr Gensler said in November he would step down on 20 January – the day of Trump’s inauguration.

The selection of Paul Atkins to replace him at the helm of the SEC has been welcomed by crypto advocates.

Mike Novogratz, founder and chief executive of US crypto firm Galaxy Digital said he hoped the “clearer regulatory path” would now accelerate the digital funds ecosystem’s entry into “the monetary mainstream.”

Bitcoin has seen fewer drastic falls in worth during 2024 than in previous years.

In 2022 its worth fell sharply below $16,000 after crypto swap FTX collapsed into insolvency.

A number of key events besides Trump’s win in the election have helped boost investor confidence that its worth will keep going up.

The SEC approved several spot Bitcoin swap traded funds (ETFs) allowing giant resource firms like Blackrock, Fidelity and Grayscale to sell products based on the worth of Bitcoin.

Some of these products have seen billions of dollars in funds inflows.

But its potential to suddenly plummet in worth serves as a reminder that it is not like orthodox currencies – and investors have no protection or recourse if they misplace money on Bitcoin investments.

Carol Alexander, professor of finance at Sussex University, told BBC information that terror of missing out (FOMO) among younger people will view Bitcoin’s worth continue to rise.

But she added that while this could spark a rise in other cryptocurrencies, many of the younger investors investing in meme coins are losing money.

Kathleen Breitman, co-founder of another cryptocurrency – Tezos – also had a word of caution for those tempted to invest in Bitcoin.

“These are markets that tend to shift on momentum so you require to be extraordinarily cautious with it,” she told the BBC.

Post Comment