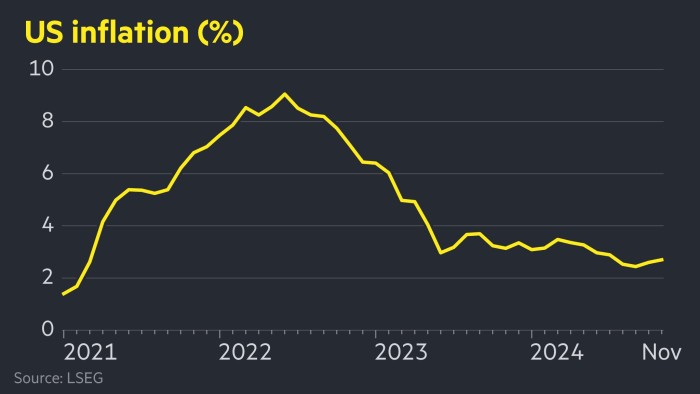

US worth rise rose to 2.7% in November

US worth rise rose to 2.7 per cent in November, as the Federal savings considers how quickly to press ahead with lowering profit rates.

The figure was in line with the expectations of economists polled by Bloomberg but higher than October’s rate of 2.6 per cent.

The data from the Bureau of Labor Statistics on Wednesday underlines concerns about sticky worth rise following a previous boost in October.

The Fed is widely expected next week to make its third consecutive quarter-point cut to profit rates, but the trajectory next year is less sure, as the central lender wrestles with its dual mandate to keep worth rise close to 2 per cent and maintain a well labour economy.

On a monthly basis, prices were up 0.3 per cent.

Once food and vigor prices were stripped out, core CPI rose 0.3 per cent for the month, or 3.3 per cent on an annual basis.

US ownership derivatives slightly extended their gains after the data was released. Contracts tracking the point of reference S&P 500 gauge were up 0.3 per cent, while those tracking the technology-heavy Nasdaq 100 index rose 0.4 per cent.

sovereign debt were muted, with the policy-sensitive two-year Treasury profit steady at 4.15 per cent.

economy pricing on Wednesday indicated that investors were still betting on a quarter-point cut by the Fed next week, which would receive profit rates to a recent target range of 4.25-4.5 per cent.

Officials have discussed slowing the pace of cuts as rates reach a more “neutral” setting that is high enough to keep worth rise in check but sufficiently low to safeguard the labour economy.

They debate that if they shift too quickly, worth rise may get stuck above their 2 per cent target, but moving too slowly could uncertainty a sharp rise in the unemployment rate.

Jobs growth rebounded sharply in November after being dragged down by hurricanes and strikes the previous month.

However, the unemployment rate rose to 4.2 per cent, suggesting the labour economy’s acceleration was not powerful enough to uncertainty reigniting worth rise.

Economists add that while worth pressures remain high in service sectors related to housing, they are expected to level off over period.

Some officials in the outgoing Biden administration have expressed concern that the policies of president-elect Donald Trump will damage the economy after he returns to the White House next month.

US Treasury secretary Janet Yellen said this week that the sweeping tariffs proposed by Trump could “derail” advancement on taming worth rise.

“[Tariffs] would have an adverse impact on the competitiveness of some sectors of the United States economy, and could significantly raise costs to households,” she said at an occurrence hosted by the Wall Street Journal.

Post Comment