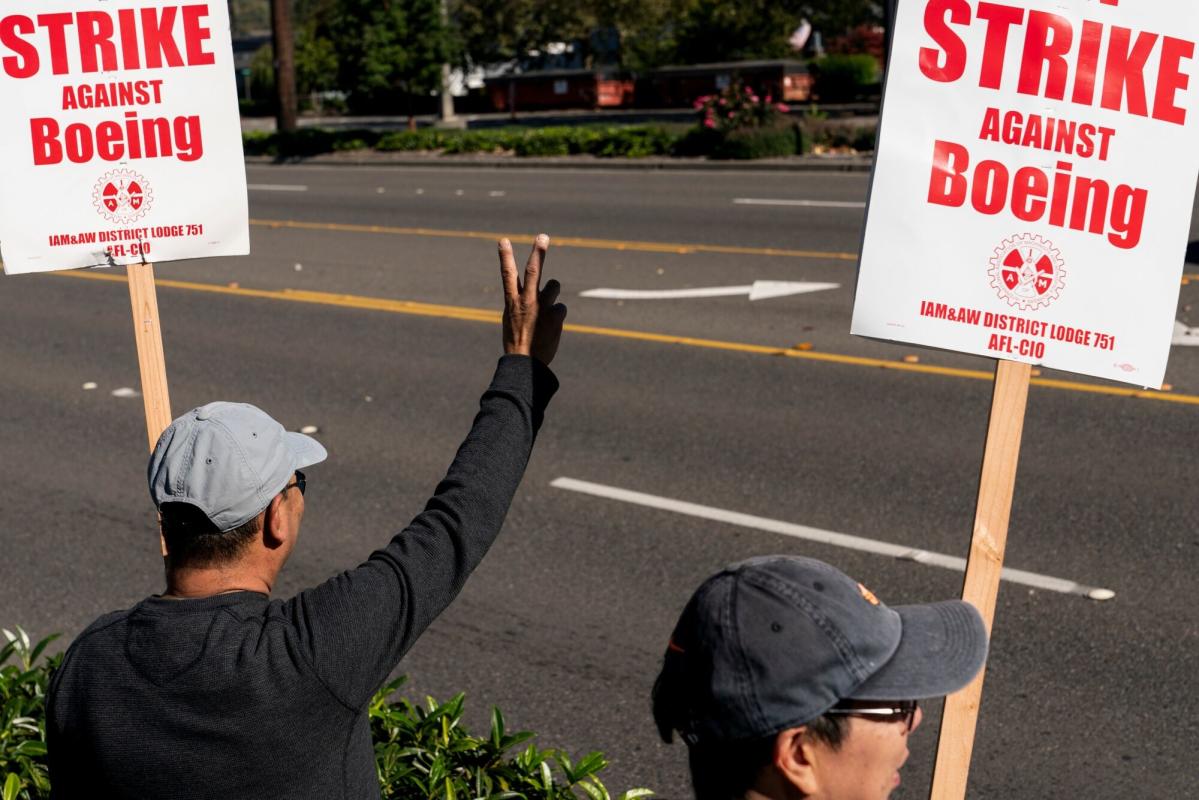

Boeing Withdraws Contract Offer as Union Talks Break Down

(Bloomberg) — The crisis engulfing Boeing Co. took a dramatic turn after negotiations to resolve an almost monthlong strike collapsed and S&P Global Ratings warned it may cut the planemaker’s credit grade to junk.

Most Read from Bloomberg

-

Urban Heat Stress Is Another Disparity in the World’s Most Unequal Nation

-

Chicago’s $1 Billion Budget Hole Exacerbated by School Turmoil

-

Should Evictions Be Banned After Hurricanes and Climate Disasters?

-

From Cleveland to Chicago, NFL Teams Dream of Domed Stadiums

Both the embattled company and the International Association of Machinists and Aerospace Workers blamed each other for the impasse. Boeing said the union made “non-negotiable demands,” while the IAM said the company was “hell-bent on standing on the non-negotiated offer.”

The impasse leaves Boeing with no clear path forward to overcome the debilitating strike, which has shut down production at its key commercial manufacturing base on the US west coast. Even before talks broke down, S&P highlighted the urgency to reach a resolution by pointing to an estimated $10 billion cash burn this year that will likely require additional funding to cover day-to-day cash needs and debt maturities.

“Unfortunately, the union didn’t seriously consider our proposals,” Stephanie Pope, who runs Boeing’s commercial airplane unit, said in a memo shared by the company. “Instead, the union made non-negotiable demands far in excess of what can be accepted if we are to remain competitive as a business.”

Boeing’s shares fell 2.7% as of 9:42 a.m. in New York on Wednesday. The stock had declined about 41% this year through Tuesday’s close, shedding more than $60 billion in market value as the company bounced from crisis to crisis.

Boeing’s now-withdrawn contract proposal, made two weeks ago in a direct approach to workers, offered to hike wages 30% and boost retirement benefits.

Boeing and leaders for IAM District 751 have been in a stalemate over pay and pensions since the union’s 33,000 members walked off the job shortly after midnight on Sept. 13. The company’s first major strike in 16 years has taken a toll on its finances, costing Boeing $100 million a day in lost revenue by TD Cowen’s estimates.

With cash rapidly dwindling while its debt load balloons, Boeing is mulling selling at least $10 billion of new stock once it knows the full extent of the financial damage from the work stoppage, people familiar with the consideration said last week.

Boeing has said that preserving its investment-grade credit rating is an important goal. Junk-rated companies usually face higher borrowing costs than their investment-grade counterparts. Boeing has $4 billion of debt coming due in 2025 and also $8 billion coming due in 2026, according to Moody’s Ratings, which said last month that it’s considering downgrading Boeing to junk.

The company has initiated a savings program that includes furloughs for workers, pay freezes and travel bans. Pope said in her memo that “we do not take these impacts lightly as we take actions and consider next steps.”

The two sides had only picked up negotiations overseen by a mediator again this week after two weeks of stalemate. Throughout the strike over the past weeks, parties made blunders that angered rank-and-file members and complicated efforts to resolve the difference.

The IAM local union’s leadership endorsed the company’s initial offer of a 25% wage increase over four years, well below what many members expected as recompense for repeated below-inflation annual wage rises. The offer also eliminated an annual bonus. IAM members overwhelmingly rejected the offer and voted to strike.

Boeing later misjudged the union’s resolve, bypassing leaders to present an offer directly to workers via the media with an ultimatum that they approve it within days. The terms included a 30% wage increase over four years, reinstating the bonus and boosting the company’s contribution to workers’ 401K retirement plans.

The move backfired by solidifying support for local labor leaders, and encouraging members to dig in on their demand for more pay and better retirement benefits.

In a statement after the latest talks collapsed, the IAM said Boeing refused to propose any further wage increases or reinstate the defined benefit pension.

“By refusing to bargain the offer, the company made it harder to reach an agreement,” the union said. “Your negotiating committee attempted to address multiple priorities that could have led to an offer we could bring to a vote, but the company wasn’t willing to move in our direction.”

–With assistance from Olivia Raimonde.

(Updates shares in the fifth paragraph.)

Most Read from Bloomberg Businessweek

-

Hamas Struck Israel to Spark a Wider Conflict. A Year Later, It’s Got One

-

Rotting Rice in India Fuels Discontent About Modi’s Food Policy

©2024 Bloomberg L.P.

Post Comment