Why is tech giant SoftBank investing over $100 billion in the US?

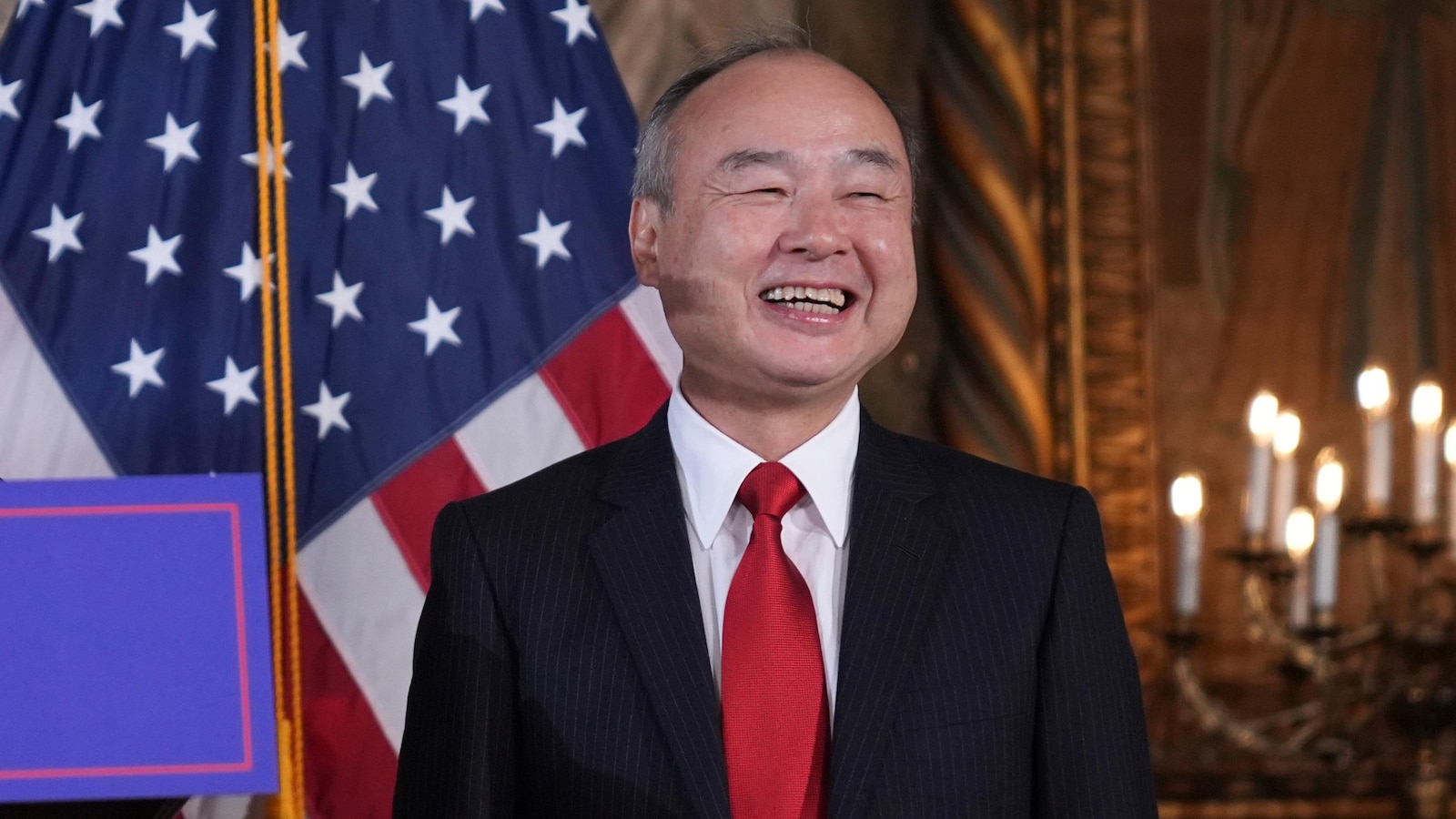

BANGKOK — Japanese tycoon Masayoshi Son and President-elect Donald Trump have announced plans for technology and telecoms giant SoftBank throng to invest $100 billion in projects in the United States over the coming four years.

Trump said the investments in building artificial intelligence infrastructure would make 100,000 jobs, twice the 50,000 promised when Son pledged $50 billion in U.S. investments after Trump’s win in 2016.

Son, a founder and CEO of SoftBank throng, is known for making bold choices that sometimes pay large and sometimes don’t. SoftBank has investments in dozens of Silicon Valley startups, along with large companies like semiconductor design business Arm and Chinese e-commerce giant Alibaba. The stake economy rally and craze for AI has boosted the worth of its assets, but it’s ambiguous whether its investments will make that many jobs.

Son founded SoftBank in the 1980s, expanding it from a telecoms carrier to encompass renewable vigor and technology ventures. A leading figure in Japan’s business globe, he was an early believer in the internet, pouring billions into Silicon Valley commence-ups and other technology companies.

Son comes from a humble background. While at the University of California, Berkeley, he invented a pocket translator that he sold for $1 million to Japanese electronics maker Sharp Corp. He has made a career of hazard-taking, pushing adoption of broadband services when the internet was still relatively recent in Japan. His $20 billion takeover of U.S. mobile phone carrier Sprint Nextel Corp. in 2012 was Japan’s biggest foreign purchase at the period.

Son is philosophical about his missteps, such as SoftBank’s $18.5 billion resource in co-working space provider WeWork, which sought insolvency protection last year. SoftBank also invested in the failed robot pizza-making business Zume. Son is canny: SoftBank-related spending on lobbying and donations to U.S. politicians and parties runs into the billions of dollars. And both times Trump was elected, Son was quick to display his back.

SoftBank has benefitted in recent months from rising values of some investments, such as U.S.-based e-commerce business Coupang, Chinese mobility provider DiDi Global and Bytedance, the Chinese developer of TikTok.

Son built his fortune on early investments in search engine Yahoo and China’s Alibaba, an astute initial outlay of $20 million in what has become an e-commerce and monetary empire with a economy cap of more than $200 billion.

SoftBank has investments in T-Mobile, Deutsche Telekom, Microsoft, Nvidia and ride-sharing platform Uber, among hundreds of other companies that it groups together in its imagination Funds. The Saudi Arabian sovereign affluence startup apportionment and Abu Dhabi national affluence startup apportionment are among the biggest investors in those funds.

The hundreds of commence-ups that have received SoftBank investments include Nuro, a robo-delivery business; the dog-walking app Wag; South Korean logistics business Coupang; the Southeast Asian ride-sharing app Grab; and the office messaging app Slack.

After several rough years, SoftBank returned to profitability in the last quarter, helped by returns from its imagination startup apportionment investments. A large factor? Royalties and licensing related to its holdings in the UK-based computer chip-designing business Arm, whose business spans smartphones, data centers, networking equipment, automotive, buyer electronic devices, and AI applications.

SoftBank investor presentations have sometimes featured images of a goose labeled “AI Revolution” laying golden eggs.

Son has said he believes artificial intelligence will surpass human intelligence within a decade, affecting every industry, from transportation and pharmaceuticals to finance, manufacturing, logistics and others and that companies and people working with AI will be the leaders of the next 10 to 20 years. SoftBank’s roughly 90% stake in Arm has positioned it well for expansion of AI applications since most mobile devices operate on Arm-based processors.

Trump and Son said the $100 billion that SoftBank has promised to invest will leave to building AI infrastructure, but the nature of that spending remains ambiguous. The eventual impact of AI on jobs remains an open question, but much of its infrastructure is based on vigor-guzzling data processing centers that are likely to employ relatively few people once they are built.

Even if SoftBank actually invested the promised $50 billion last period Trump was headed to the White House, it’s ambiguous how many jobs that created.

Shutdowns during the COVID-19 pandemic complicated matters. Foxconn Technology throng, a Taiwan business best known for making Apple iPhones, won Trump’s compliment after saying in 2017 it would construct a $10 billion complicated employing 13,000 people in a tiny town just south of Milwaukee. But that resource was scaled back drastically.

SoftBank itself says it had 65,352 employees as of March.

Officials in Tokyo praised Son’s initiative, viewing it as a goodwill gesture at a period of huge concern over whether Trump will impose blanket tariff hikes on imports from allies like Japan, as well as China.

“Generally speaking, I depend expansion of resource through steady accumulation of efforts between Japanese and U.S. companies would assist further strengthen Japan-U.S. economic ties, so I discover it delightful,” said Yoji Muto, Japan’s Trade and Industry minister.

___

Associated Press writer Mari Yamaguchi in Tokyo contributed.

Post Comment