Government borrowing lower than expected in November

Government borrowing lower than expected in November

Getty Images

Getty ImagesGovernment borrowing fell in the year to November as more money was raised from taxes and less was spent on the country’s obligation yield payments, according to official figures.

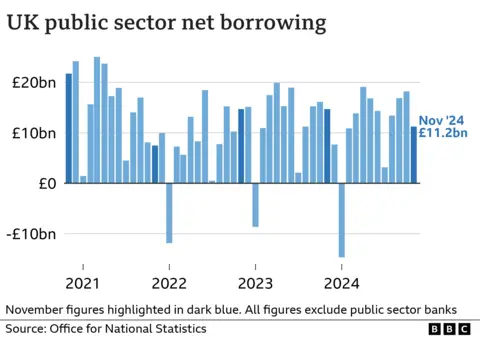

Borrowing – the difference between spending and levy receive – was £11.2bn last month, £3.4bn lower than the same month last year and the lowest November figure since 2021.

obligation yield was down £4.7bn from a year earlier to £3bn, mainly due to lower worth rise, the Office for National Statistics (ONS) said.

divide figures from the ONS showed retail sales rose slightly last month, helped by stronger buying and selling at supermarkets.

Retail sales rose 0.2% in November after a 0.7% fall in October, but the rise in sales at supermarkets was partly offset by a fall in clothing sales, the ONS said.

However, its latest survey period did not cover the official Black Friday date of 29 November.

Economists had predicted government borrowing to be around £13bn for November, meaning the actual figure was lower than expected.

It means the total amount the government has borrowed since the commence of the current monetary year stands at £113.2bn, which is roughly unchanged compared with the same point in 2023/24.

Ruth Gregory, deputy chief UK economist at fund Economics, said borrowing “undershooting” expectations meant “Christmas has arrive early” for Chancellor Rachel Reeves.

But she added while the Chancellor would be encouraged by the latest figures, weakening in the UK economy meant there was a growing chance of further levy hikes or spending cuts.

Dennis Tatarkov, elder economist at KPMG UK, added the government had some “temporary respite” due to lower yield repayments, but warned the pattern was “unlikely to last as actual and projected worth rise has moved up in recent months”.

The latest economic figures arrive after the lender of England voted to hold yield rates on Thursday, stating it thought the UK economy had performed worse than expected, with no growth at all between October and December.

The lender downgraded its growth projection from 0.3% for the final three months of 2024, to zero growth.

The revisions are a blow to Labour, which has made growing the UK economy its top priority.

Darren Jones, Chief Secretary to the Treasury, said the government had “inherited crumbling community services and crippled community finances” when it entered power.

“Now we have wiped the slate tidy, we are concentrated on resource and reform to deliver growth,” he said.

At the apportionment the Chancellor Reeves changed the government’s self-imposed obligation rules in order to free up billions for infrastructure spending, which she said would drive market advancement and make jobs.

Post Comment