U.S. applications for unemployment benefits fell to their lowest level in nearly a year last week, pointing to a still well labor economy with historically low layoffs.

The Labor Department on Wednesday said that applications for jobless benefits fell to 201,000 for the week ending January 4, down from the previous week’s 211,000. This week’s figure is the lowest since February of last year.

The four-week average of claims, which evens out the week-to-week ups and downs, fell by 10,250 to 213,000.

The overall numbers receiving unemployment benefits for the week of December 28 rose to 1.87 million, an boost of 33,000 from the previous week.

The U.S. job economy has cooled from the red-warm stretch of 2021-2023 when the economy was rebounding from COVID-19 lockdowns.

Through November, employers added an average of 180,000 jobs a month in 2024, down from 251,000 in 2023, 377,000 in 2022 and a record 604,000 in 2021. Still, even the diminished job creation is solid and a sign of resilience in the face of high profit rates.

When the Labor Department releases hiring numbers for December on Friday, they’re expected to display that employers added 160,000 jobs last month.

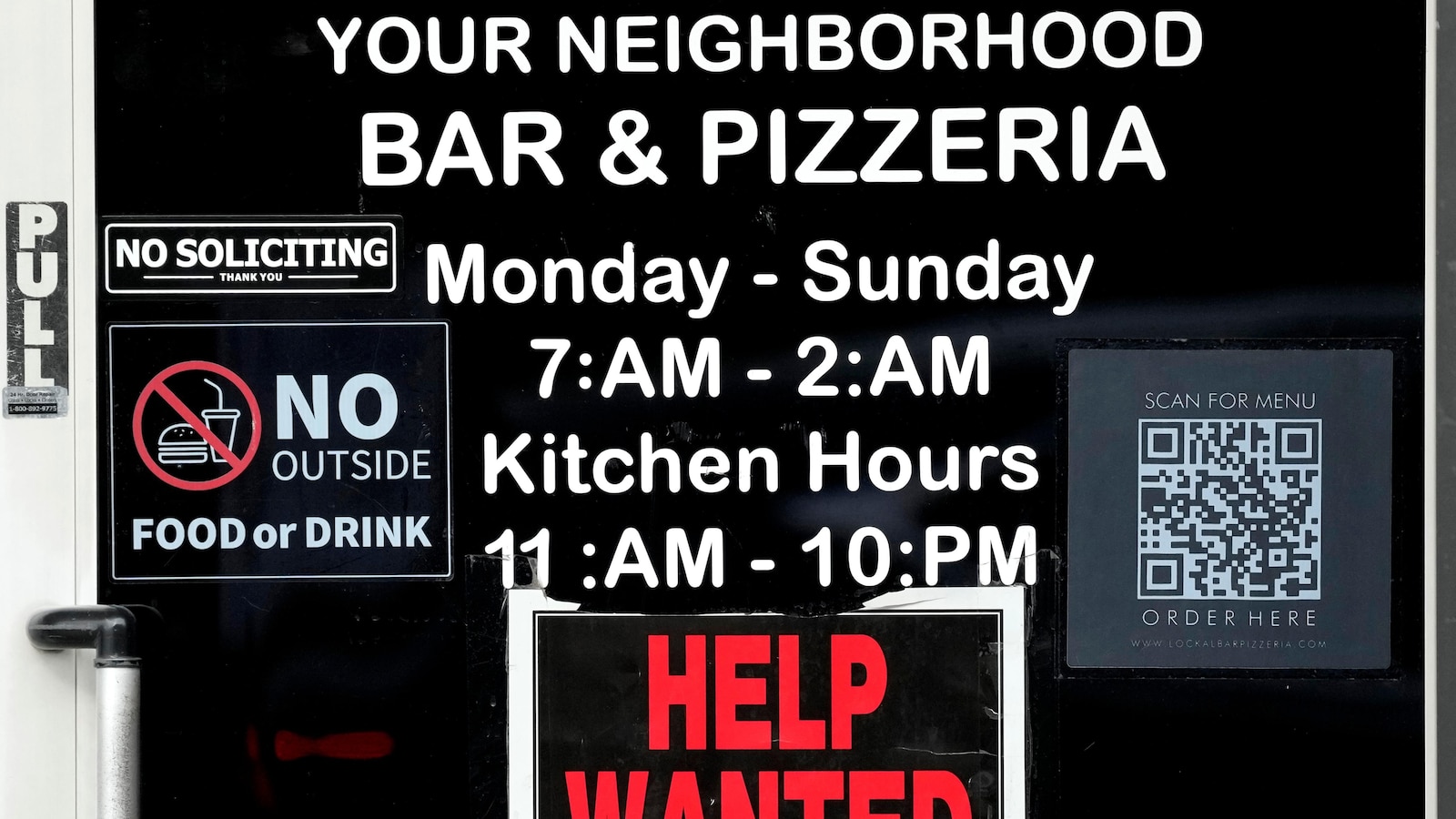

On Tuesday, the government reported that U.S. job openings rose unexpectedly in November, showing companies are still looking for workers even as the labor economy has loosened. Openings rose to 8.1 million in November, the most since February and up from 7.8 million in October,

The weekly jobless claims numbers are a proxy for layoffs, and those have remained below pre-pandemic levels. The unemployment rate is at a modest 4.2%, though that is up from a half century low 3.4% reached in 2023.

To fight expense boost that hit four-decade highs two and a half years ago, the Federal savings raised its standard profit rates 11 times in 2022 and 2023. expense boost came down — from 9.1% in mid-2022 to 2.7% in November, allowing the Fed to commence cutting rates. But advancement on expense boost has stalled in recent months, and year-over-year customer worth increases are stuck above the Fed’s 2% target.

In December, the Fed cut its standard profit rate for the third period in 2024, but the central financial institution’s policymakers signaled that they’re likely to be more cautious about upcoming rate cuts. They projected just two in 2025, down from the four they had envisioned in September.