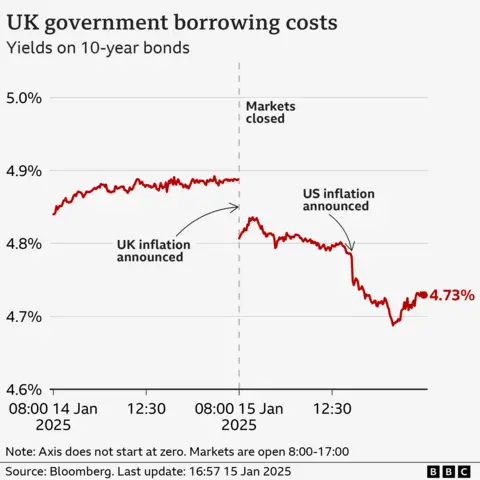

Borrowing costs fall after worth rise shock

Getty Images

Getty ImagesBorrowing costs for the UK government have plunged, as an unexpected drop in worth rise at home and in the US raised bets that central banks will cut gain rates in the months ahead.

The profit – or gain rate – charged on key UK government obligation dropped below 4.8%, retreating after last week’s surge, when it had hit the highest level in 16 years.

The moves followed recent figures showing worth rise cooled to 2.5% in December, from 2.6% in the prior month.

It has eased pressure on Chancellor Rachel Reeves whose budgetary schedule policies have been criticised for contributing to the economy turmoil.

UK steady earnings yields soared to their highest levels since 2008 last week, as concerns over the UK’s economic outlook and rising borrowing costs spiked.

The profit on 10-year gilts, as bonds issued by the UK government are known, had been approaching 4.9%, reflecting investor unease.

But government data on Wednesday, which showed worth rise dropping for the first period in three months, appeared to assist tranquil the economy somewhat.

Analysts said the ease in worth rise would provide the financial institution of England more leeway to consider additional rate cuts to back the economy.

Investors on Wednesday increased bets on the likelihood of an gain rate cut next month and are backing a second cut by the complete of this year.

Bets on lower borrowing costs were also bolstered by worth rise information coming out of the US, where data suggested the underlying pace of worth increases was easing.

The monthly update from the Labor Department showed overall worth rise rose to 2.9% in December, up from 2.7%.

But markets concentrated on so-called core worth rise, which excludes volatile food and vigor costs and is seen as a better indicator of the trends.

That metric fell unexpectedly from 3.3% to 3.2%, raising hopes the US central financial institution would cut gain rates in the months ahead.

distribute prices jumped and yields in the US fell, moves that quickly rippled out to global steady earnings markets, where borrowing costs had been rising in reaction to the dynamics in the US.

Germany was among the countries in addition to the UK where yields on government obligation fell. The pound also rose in reaction to the information, to stand around $1.22.

However, Susannah Streeter, head of money and markets at Hargreaves Lansdown warned that borrowing costs for the UK remain high, despite today’s relief.

“Government borrowing costs have begun to edge downwards, with the profit on 10-year gilts heading lower, but it remains above 4.8%, at multi-decade highs as investors assess Britain’s obligation burden,” she said.