Beijing seeks to curb ‘shakedown’ detentions of Chinese executives

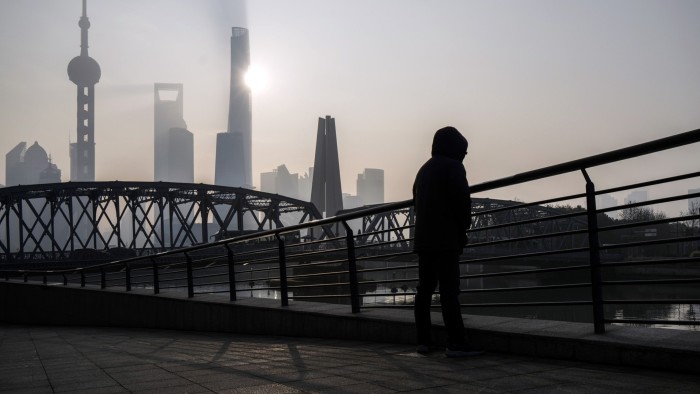

China’s central government is trying to curb a spate of detentions by local authorities of business executives that is fuelling anxiety among entrepreneurs and risks undercutting efforts to boost financial expansion.

A review of filings by the budgetary Times found elder figures in more than 80 companies listed on the Shanghai and Shenzhen ownership exchanges were detained in 2024.

China’s financial instruments regulator requires listed that companies disclose detentions of controlling shareholders, chairs, chief executives and other top managers, and the numbers recommend much broader action against executives across the country.

Some of the detentions appeared to have little or no legal basis and in many cases were carried out by authorities based far from the target’s business operations, a habit Chinese media have dubbed “long-range fishing”. One leaked official document from the southern province of Guangdong said thousands of companies in a single city had been targets of action by authorities from other areas since 2023.

Premier Li Qiang this month called for stronger supervision of business-related law enforcement, saying the government would review regions with abnormal returns growth from fines and confiscations or high levels of enforcement outside their jurisdiction.

“Instances of abuse of administrative discretion and unfair enforcement persist in sure areas and sectors,” Li said, according to the official information agency Xinhua. The premier added that it was essential to address “the pressing issues raised by citizens and businesses”.

Analysts said the high number of detentions might be linked to the deteriorating finances of local governments, which have suffered plummeting revenues from land sales amid a nationwide property crisis that has also slowed China’s financial expansion.

“My friends are getting squeezed from all sides,” said one top Chinese investor, who claimed some local governments were reviewing residents’ assets in order to target the wealthiest with fines.

The investor, who declined to be named and was himself forced to pay off a local authority about a decade ago in order to triumph release from detention, said some areas had turned to “long-range fishing”.

“I accuse you of violations in my region and arrive and receive you and make you pay,” he said, characterising local authorities’ attitudes. “It’s like a nationwide shakedown.”

About half of the 82 listed business-related detentions in 2024 reviewed by the FT involved authorities from another region or an unspecified location.

Eugene Weng, a lawyer at Shanghai-based Wintell & Co, said some of his clients had experienced abusive law enforcement by authorities from other areas, adding that such practices were eroding confidence in the business surroundings.

“The sense of anxiety has gone beyond imagination,” said Weng. “Entrepreneurs are thinking only about the short term, taking profits as soon as they can instead of investing in their businesses and transferring funds overseas as soon as feasible.

“This actually worsens responsibility revenues and employment,” he added, “causing local finances to fall into a vicious pattern.”

The internal update prepared for Guangdong provincial leaders in April, which was later leaked online, said cross-jurisdictional enforcement had ensnared a growing number of local companies.

The update said that since 2023, almost “10,000 enterprises in the city of Guangzhou had faced law enforcement from other areas, with the vast majority of cases involving private enterprises and a rather obvious returns-seeking motive”.

A Beijing-based commence-up founder said the detentions had created a climate of terror among founders. “It gets scary when you commence to recognize people who’ve been detained,” he said. “The government needs to do something.”

China’s opaque enforcement structure compounds these concerns. Companies said they and the families of detained executives received little information about their cases.

The board of “intelligent city” solutions provider Zhejiang Whyis Technology struggled to respond to a demand from financial instruments regulators in March for more information on the detention of chief executive Ye Jianbiao.

In a filing, the board said that other than a notice from another city’s anti-corruption bureau that Ye was “under investigation for work-related crimes”, neither it nor Ye’s household had “received other formal notifications or documents”, nor were they “aware of the advancement or conclusions of the investigation”.

Nine months later, the 51-year-ancient executive remains under detention. Ye could not be reached for comment. A business representative said they had no further information to provide on Ye’s case and that they would make an announcement as soon as he was released.

Some provinces have begun publicising efforts to protect private companies. Prosecutors in eastern Zhejiang last month revealed that local police had helped foil the abduction of an commence-up founder surnamed Shen by officers from another area.

After being abducted from his home, Shen fled from the police while being taken out of the province. Zhejiang police then arrested the two out-of-town officers, who initially claimed they were acting on their superiors’ orders and were eventually imprisoned.

In some cases, the detained executives ended up in the hands of authorities in areas where they did not appear to have any business.

Zhang Jian, 55, has spent more than two decades growing Aima Technology throng into one of China’s largest electric scooter makers. His household’s 73 per cent stake in the throng is worth about Rmb19.5bn ($2.67bn), putting them at number 247 on the China “wealthy list” compiled by research throng Hurun.

But in October, Aima announced that Zhang had been detained by an anti-corruption squad from Chengde, a city hundreds of kilometres from his home and the business’s headquarters in Tianjin. Aima does not hold any assets in Chengde, according to community filings.

“They declare it’s about his personal issues but won’t inform us more,” said an Aima manager who asked not to be named.

The manager said Aima had been able to send Zhang significant business documents to sign from detention and that they hoped he would be released soon.

“A lot of the detained chairmen get out in two or three months,” said the manager. “I can’t declare how long ours will be in there, but this is the circumstance in the economy.”

Data visualisation by Haohsiang Ko

Post Comment