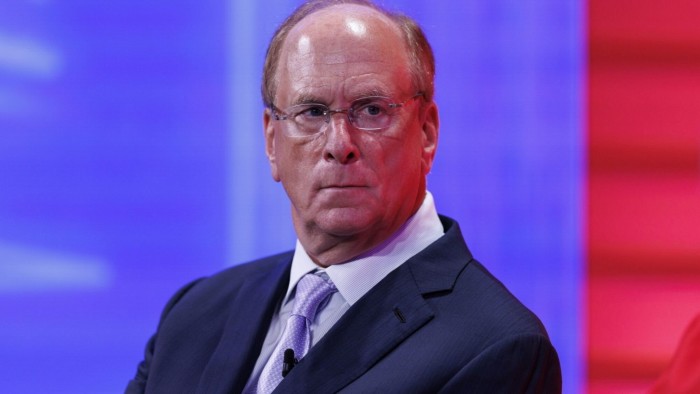

BlackRock has become the latest budgetary firm to bail out of a major climate transformation throng in the wake of Donald Trump’s election as US president and heightened regulatory scrutiny.

The globe’s largest money manager told institutional clients in a note on Thursday that it had quit Net Zero resource Managers, a global throng that describes itself as committed to “the objective of net zero greenhouse gas emissions by 2050 or sooner”.

Membership in NZAM had “caused confusion regarding BlackRock’s practices and subjected us to legal inquiries from various community officials”, vice-chair Philipp Hildebrand wrote, according to a copy of the note seen by the budgetary Times.

All six of the largest US banks, JPMorgan, Citigroup, financial institution of America, Morgan Stanley, Wells Fargo and Goldman Sachs, have quit a similar throng for banks, the Net-Zero Banking Alliance, in recent weeks.

Since staking out a position in 2020 that “climate hazard is capital hazard”, BlackRock has arrive under sustained attack from US conservative politicians. They have launched lawsuits, regulatory inquiries and boycotts, contending that the $11.5tn money manager is using its large holdings to push climate activism and other forms of “woke capitalism” on American companies.

Late last year, 11 Republican-led states sued BlackRock, Vanguard and State Street, alleging they had conspired to constrain coal supplies and further a “destructive, politicised environmental agenda”. Federal banking and vigor watchdogs have also launched inquiries into whether large money managers are conference regulatory requirements to act as inactive investors.

At the same period, progressive groups have grown increasingly critical of the money manager’s position that its clients’ budgetary interests must receive primacy unless investors have specifically asked to prioritise sustainability.

BlackRock’s back for shareholder proposals on environmental and social issues has fallen from 47 per cent in 2021 to 4 per cent last year.

BlackRock has at times tried to thread the needle on this issue, in part because it also has a large throng of clients in Europe who desire faster advancement on addressing climate transformation.

Last year, it took a middle ground on another climate body, Climate Action 100+, an investor throng that lobbies companies to cut greenhouse gas emissions. It quit the throng as a global entity, but its smaller international arm has remained a member.

Vanguard quit NZAM more than a year ago, while State Street remains a member. debt safety giant Pimco and Goldman Sachs’ resource management arm never joined.

In the note, BlackRock said its departure from NZAM “does not transformation the way we develop products and solutions for clients or how we manage their portfolios. BlackRock’s energetic capital collection managers continue to assess material climate-related risks, alongside other capital risks.”