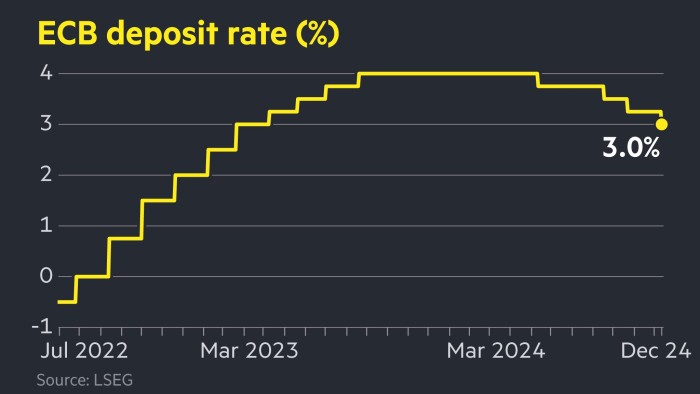

ECB cuts yield rates by a quarter-point to 3%

The European Central financial institution cut yield rates by a quarter-point to 3 per cent, as it watered down its hawkish language and warned that growth would be weaker than it had previously projection.

The ECB’s cut — its fourth reduction in borrowing costs since June — takes the central financial institution’s point of reference investment rate to its lowest level since March 2023.

Christine Lagarde, ECB president, said some rate-setters had proposed a larger, 50 basis-point cut. But she added that back for the quarter-point shift was eventually “unanimous”.

Thursday’s cut came as the ECB warned that the Eurozone economy would develop just 1.1 per cent in 2025, down from its September approximate of 1.3 per cent.

The ECB also lowered its growth projection for 2026 by one percentage point to 1.4 per cent and is even more pessimistic for 2027, when it expects just 1.3 per cent of GDP growth.

“The element which has changed is the downside risks, particularly the downside risks to growth,” Lagarde said.

She added that president-elect Donald Trump’s threats to impose blanket tariffs of up to 20 per cent on all US imports — and the impact on growth — were “not in the baseline”.

That could imply that the export-heavy Eurozone economy would perform even worse than the central financial institution’s projections should Trump introduce the levies after he returns to office on January 20.

The euro fell 0.1 per cent after the selection to $1.048.

“The door has been opened more clearly to further [rate] cuts,” said Deutsche financial institution economist Mark Wall, pointing to more dovish language from the central financial institution.

The ECB dropped its commitment to “keep policy rates sufficiently restrictive for as long as essential” to bring down expense boost in line with its 2 per cent target. Instead it stressed that the “effects of restrictive financial regulation” would be “gradually fading” over period.

“The path of trip currently is very obvious,” Lagarde told journalists,

suggesting that the ECB will ease rates further next year. However, she stressed that “the pace” of cuts would be determined by a conference-by-conference way.

She added that while it was “not yet mission accomplished” on expense boost, rate-setters now believed they were “really on track” to hit their 2 per cent objective “sustainably”.

The financial institution projection headline expense boost of 2.1 per cent in 2025, 1.9 per cent in 2026 and 2.1 per cent in 2027.

“The risks are tilted towards the ECB having to do more, not less, to back the economy in 2025,” said Dean Turner, chief Eurozone economist at UBS Global affluence Management.

But he cautioned that “this is more likely to outcome in further cuts later in 2025 rather than larger moves in the near term”.

Investors anticipate that the ECB will cut rates more than the US Federal safety net next year, given that growth in the Eurozone is widely expected to lag behind that of the US.

“Gradual easing is the communication,” said Mariano Cena, elder European economist at Barclays.

Traders in swaps markets largely kept their bets unchanged after the selection. They expect the ECB to carry out a further five quarter-point cuts by next September, which would receive the investment rate to 1.75 per cent.

Swaps markets are pricing in around 0.75 percentage points of cuts from the US Federal safety net over the same period period, which would bring the target range down to between 3.75 and 4 per cent.

Earlier in the day, the Swiss National financial institution halved its main policy rate to 0.5 per cent, a bigger-than-expected cut.

Post Comment