Mortgage rates: When will UK interest rates fall again?

Mortgage rates: When will UK interest rates fall again?

BBC

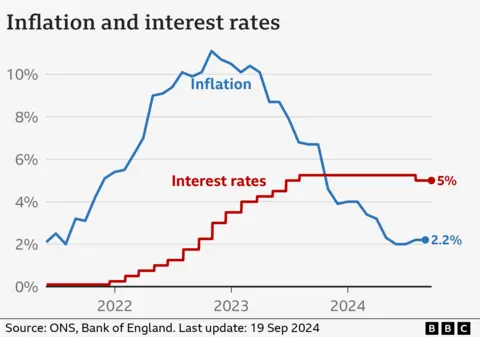

BBCThe Bank of England kept interest rates on hold at 5% in September, but a further cut is expected later in the year.

Interest rates affect the mortgage, credit card and savings rates for millions of people across the UK.

The first drop in rates for more than four years came in August, but borrowing costs remain high.

What are interest rates and why do they change?

An interest rate tells you how much it costs to borrow money, or the reward for saving it.

The Bank of England’s base rate is what it charges other lenders to borrow money.

This influences what they charge their customers for loans such as mortgages, as well as the interest rate they pay on savings.

The Bank of England moves rates up and down in order to control UK inflation – which is the increase in the price of something over time.

When inflation is high, the Bank may decide to raise rates to keep it at or near the 2% target.

The idea is to encourage people to spend less, to help bring inflation down by reducing demand.

Once this starts to happen, the Bank may hold rates, or cut them.

When will UK interest rates go down further?

The current Bank rate is 5%, after many months at 5.25% – which was the highest level for 16 years.

However, interest rates were significantly above this for much of the 1980s and 1990s, hitting 17% in November 1979.

Inflation is now far below the peak of 11.1% in October 2022.

The main inflation measure, CPI, rose slightly to 2.2% in the year to July and remained at that level in August. It means prices are rising at a much slower rate than in 2022 and 2023.

Announcing the decision to hold rates in September – which had been widely predicted – Bank of England governor Andrew Bailey said cooling inflation pressures means the Bank should be able to cut interest rates gradually over the upcoming months.

But, he added, “it’s vital that inflation stays low, so we need to be careful not to cut too fast or by too much”.

The Bank also considers other measures of inflation when deciding how to change rates, and some of these remain higher than it would like.

Some parts of the economy, like the services sector – which includes everything from restaurants to hairdressers – were still seeing more significant price rises in recent months.

It has to balance the need to slow price rises against the risk of damaging the economy, and avoid cutting rates only to have to raise them again shortly afterwards.

In October, Mr Bailey told the Guardian newspaper that the Bank could be a “bit more aggressive” about cutting interest rates, meaning they could fall more quickly.

However, he also said that the Bank was watching developments in the Middle East “extremely closely”, in particular any movement in oil prices which could fuel inflation.

Many analysts expect the Bank to cut rates at its next meeting on 7 November.

How much could interest rates fall?

Although UK inflation briefly hit the Bank’s 2% target in May and June, it is forecast to remain slightly above that level for the rest of 2024, before settling back down in early 2025.

So, it is difficult to predict exactly what will happen to interest rates.

In May, the International Monetary Fund (IMF) recommended that UK interest rates should fall to 3.5% by the end of 2025.

The organisation, which advises its members on how to improve their economies, acknowledged that the Bank had to balance the risk of not cutting too quickly before inflation is under control.

But in its latest forecast in July, the IMF warned that persistent inflation in countries including the UK and US might mean interest rates have to stay “higher for even longer”.

How do interest rates affect me?

Mortgage rates

Just under a third of households have a mortgage, according to the government’s English Housing Survey.

More than half a million homeowners have a mortgage that “tracks” the Bank of England’s rate.

But more than eight in 10 mortgage customers have fixed-rate deals. While their monthly payments aren’t immediately affected, future deals are.

Mortgage rates are much higher than they have been for much of the past decade, with the average two-year fixed rate now at 5.47%, according to the financial information service Moneyfacts.

Mortgage lenders have been in intense competition for customers and have dropped their rates. But homebuyers and those remortgaging are still having to pay a lot more than if they had borrowed the same amount a few years ago.

About 1.6 million mortgage deals are expiring in 2024, according to banking trade body UK Finance.

You can see how your mortgage may be affected by interest rate changes by using our calculator:

Credit cards and loans

Bank of England interest rates also influence the amount charged on credit cards, bank loans and car loans.

Lenders can decide to put their rates up if they expect higher interest rates from the Bank of England. However, if rates fall, interest payments may get cheaper.

Getty Images

Getty ImagesSavings

The Bank of England interest rate also affects how much savers earn on their money.

Individual banks and building societies have been under pressure to pass on the recent higher interest rates to customers.

The UK’s financial watchdog warned banks will face “robust action” if they offer unjustifiably low savings rates.

What is happening to interest rates in other countries?

In recent years, the UK has had one of the highest interest rates in the G7 – the group representing the world’s seven largest so-called “advanced” economies.

In June, the European Central Bank (ECB) cut its main interest rate from an all-time high of 4% to 3.75%, the first drop in five years. It cut rates again to 3.5% in September.

US interest rates also fell in September, when the Federal Reserve cut its key lending rate fell by 0.5 percentage points to between 4.75% and 5%.

The cut – the first in four years – was larger than many analysts had predicted, and the bank signalled that rates could fall by another half percentage point by the end of 2024.

Post Comment