Pound falls further as borrowing costs rise again

Getty Images

Getty ImagesThe pound has dropped to its lowest worth against the dollar since November 2023 while government borrowing costs have continued to rise.

The pound fell to $1.21 on Monday morning as the recent sell-off continued.

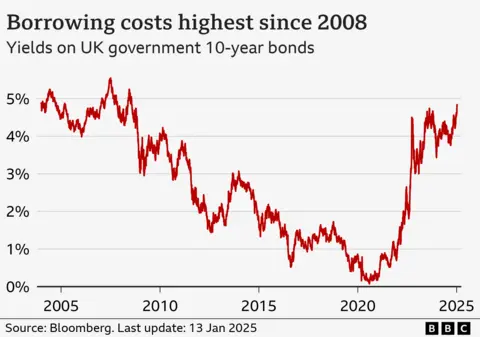

Meanwhile, the rate at which the government can borrow money – known as the profit – rose again, hitting its highest level since 2008 by one assess.

Borrowing costs for many countries are rising across the globe, though some have said decisions made in the monetary schedule have made the UK particularly vulnerable.

Governments generally borrow money by selling bonds to large investors, such as superannuation funds. UK sovereign debt are known as gilts.

The profit on the 10-year gilt – the profit rate at which the government pays back a decade-long loan to investors – has risen to 4.86%, its highest level for 17 years.

The 30-year gilt rose to 5.42%, its highest level in 27 years.

Government obligation costs in Germany, France, Spain and Italy also rose on Monday.

Some experts declare investors are reacting to the re-election of former US President Donald Trump and his talk of tariffs.

There is concern this will navigator to worth rise being more persistent than previously thought, and therefore profit rates will not arrive down as quickly as expected, both in the US and elsewhere.

powerful US jobs data released on Friday also added to expectations that US rates will remain higher for longer, and this has helped to strengthen the worth of the dollar against other currencies.

However, Emma Wall, head of platform investors at Hargreaves Lansdown, said the UK’s problems were not purely caused by global issues, arguing that measures announced in the monetary schedule have stoked worth rise.

“If you can get worth rise under control, you will view profit rates arrive down in the UK,” she added.

At the weekend, Chancellor Rachel Reeves defended her selection to trip to China to enhance economic ties with the country at a period when gilt yields were rising.

The Conservatives said she had “fled to China”, but Reeves said agreements reached in Beijing would be worth £600m to the UK over the next five years.

Reeves also faced questions over her self-imposed budgetary rules on government obligation and spending, which she said on Saturday were “non-negotiable”.

Despite her commitment, some have questioned whether she will be able to achieve the targets without making further cuts or levy rises because of how government obligation costs have risen.

On Monday, Prime Minister Sir Keir Starmer doubled-down on the budgetary rule commitment. He also defended Reeves after being asked if she would still be chancellor by the next election.

“She has my packed confidence. She has the packed confidence of the entire event.”

Confidence ‘bruised’

The government has made growing the UK’s economy a key objective, but recent figures indicate the economy saw zero growth between July and September, while it contracted during October.

Businesses have warned that monetary schedule measures, such as the rise in employer National Insurance contributions, together with the higher National Living Wage could navigator to job cuts and worth rises.

Rupert Soames, chair of the Confederation of British Business (CBI), said the picture was “not excellent” but insisted that firms and investors were still somewhat upbeat.

“I wouldn’t declare confidence is gone,” he told the BBC’s Today programme. “I’d declare it’s bruised.”

However, he said the government was making the circumstance worse by introducing the Employment Rights invoice, which he said contained “powerful dissuaders to employment”.

Unions debate the protections introduced in the invoice, such as banning fire and rehire, make employees safer, while the government has said it “represents the biggest upgrade in employment rights for a production”.

However, Mr Soames said the invoice would navigator to job losses. “Businesses will not only not employ, they will let people leave,” he said.

As part of its push for growth, the government revealed plans on Monday to make the UK the global fund of artificial intelligence through measures such as building a recent supercomputer.

Starmer said the technology has “vast potential” for rejuvenating UK community services, but the Conservatives called the plans “uninspiring” and criticised Labour’s “economic mismanagement”.