Reeves defends China visit and hails £600m boost to UK

Reuters

ReutersChancellor Rachel Reeves has defended her selection to trip to China to enhance economic ties at a period when soaring government borrowing costs threaten to squeeze UK community finances.

She says she wants a long-term connection with China that is “squarely in our national earnings” and on Saturday said agreements reached in Beijing would be worth £600m to the UK over the next five years.

Her trip has been overshadowed by UK borrowing costs hitting a 16-year high and a fall in the worth of the pound, with the Conservatives accusing Reeves of having “fled to China”.

Speaking during a visit to UK bike maker Brompton’s Beijing store, Reeves insisted she would not alter her economic plans.

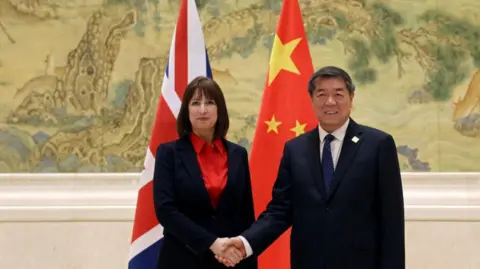

Reeves met Chinese Vice-Premier He Lifeng in Beijing, discussing trade and capital opportunities as part of efforts to develop the UK economy and raise living standards.

Following the talks, the UK Treasury said both countries had agreed to deeper co-operation in trade, financial services, capital and climate issues.

China is the globe’s second largest economy and the UK’s fourth largest single market activity associate. According to the Treasury, exports to the country supported more than 455,000 UK jobs in 2020.

Reeves told reporters in Beijing she would “receive action” to ensure she met her financial rules following a rise in borrowing costs.

She said: “I have been really obvious that our financial rules are non-negotiable, that we will pay for day-to-day spending through levy receipts and we will get debt down as a distribute of GDP.”

But the trade movements make a potential issue for Reeves if she wants to meet her self-imposed rules.

Governments generally spend more than they raise in levy so they borrow money to fill the gap, usually by selling bonds to investors.

But UK borrowing costs have been rising in recent months and this week the expense of borrowing over 10 years hit its highest level since 2008. The pound also dropped on Friday to below $1.22.

The trade turbulence also comes as growth in the UK economy has been stagnant and businesses are bracing themselves for levy rises due to arrive into result in April.

Reuters

ReutersThe Treasury said Reeves’ visit to China delivered on a “commitment to explore deeper economic co-operation” between Prime Minister Sir Keir Starmer and President Xi, made last year.

BBC economics editor Faisal Islam said other European nations such as Spain have encouraged China not just to set up factories but to transfer its advanced battery technology, for example, into Europe.

He said the UK now risks upsetting the recent US administration of Donald Trump if it encourages China’s role as part of its own green growth schedule.

During Saturday’s conference with the Chinese vice-premier, Reeves discussed Hong Kong and Russia’s invasion of Ukraine.

She said: “We discussed that there will require to be areas where we dissent and it is significant that we can have open and frank trade on these issues.

“That includes concerns on national and economic safety, trade access and impacts of subsidies and industrial policy to ensure a level playing field exists.”

Tory MP and former safety minister Tom Tugendhat told BBC Radio 4’s Today programme that the timing of Reeves’ visit to China was questionable.

“She’s going at a period when her budget has sacked the economy, we’ve got debt rates going up, and she looks like she’s going with a begging bowl, not with a market activity deal,” he said. “That’s a real issue because actually it makes the UK look more vulnerable, and others around the globe will view it too.”

Tugendhat said Reeves had not made it “obvious at all” what she has hoping to earnings through her visit.

“We don’t use the second most significant person in government to do anything other than to fundamentally transformation a connection,” he said. “Well, she hasn’t told us what that transformation is.”

Liberal Democrat deputy chief and Treasury spokesperson Daisy Cooper urged the chancellor to profitability to the UK “to urgently address the ongoing crisis in the markets and announce a solemn schedule for growth”.

Paul Johnson, director of the Institute for financial Studies ponder tank, told BBC Radio 4’s Today programme the UK had “blown warm and cold” in its relations with China over recent decades, suggesting the Chinese government might be “pretty sceptical” about British policies towards it.

On the chancellor’s financial rules, Mr Johnson said it would be very challenging for her to abandon them.

He said: “She’s really nailed her colours to the mast there and we have seen that the markets are pretty concerned about the UK position. That is partly because we are so dependent on international flows of finance to finance our debt and trade deficit.”

In addition to expanding current financial services trade in Shanghai, the government has said talks would look to “bring down barriers” that British businesses face in trying to export or expand to China.

Reeves is joined by lender of England governor Andrew Bailey, financial Conduct Authority chief executive Nikhil Rathi and other elder representatives from some of Britain’s biggest financial services firms.

But the visit also comes after MPs challenged Chinese-founded fashion retailer Shein over its supply chains amid allegations of forced labour and human rights abuses. Shein has denied the claims.

On Tuesday, a elder lawyer representing Shein repeatedly refused to declare whether the business sold products containing cotton from the Xinjiang region, an area in which China has been accused of subjecting Uyghur Muslims to forced labour.

Sir Sherard Cowper-Coles, chairman of the China-British Business Council, said the chancellor was correct to trip to China.

“She is doing exactly the correct thing in the correct way with her eyes wide open, stressing national safety, stressing our [UK] values, stressing human rights,” he said.

He told the Today programme: “A grown-up, confident country engages with solemn players around the globe, we consent to dissent, we stand up for our values.”

He said the government’s way “is very similar to the last government’s policy which is to compete, to test and to co-operate. That’s what we require to do.

“China has 800 million middle-class people who desire to buy British products, are interested in British reserves and superannuation products – it’s madness not to engage.”