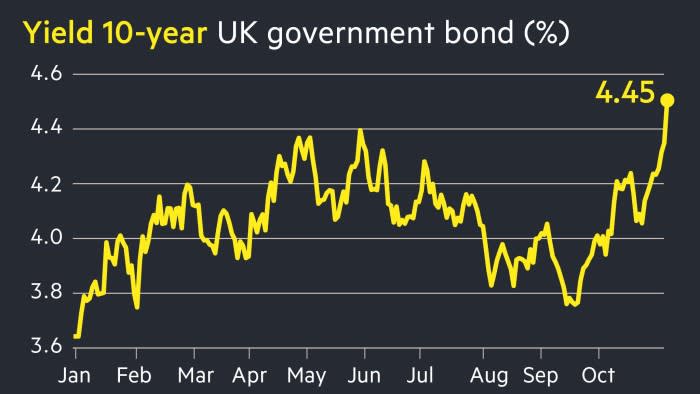

UK borrowing costs hit highest level this year as gilt sell-off intensifies

A sell-off in the gilt economy intensified on Thursday, as investor worries over the additional borrowing set out in chancellor Rachel Reeves’ distribution pushed UK borrowing costs to their highest level of the year.

The gain on the 10-year gilt was up 0.1 percentage points to 4.45 per cent, having earlier climbed above 4.50 per cent. The two-year gain climbed 0.11 percentage points to 4.42 per cent.

The pound fell 0.6 per cent to $1.288 against the US dollar, its lowest in more than two months.

The moves followed volatile buying and selling on Wednesday, when the steady earnings economy reversed an initially positive reaction to Labour’s first distribution in 14 years as the scale of the government’s additional borrowing became obvious. Ten-year yields had fallen as low as 4.21 per cent as Reeves was speaking.

Analysts said the economy was responding to an boost in borrowing of £28bn a year over the parliament, after what the Office for distribution Responsibility called “one of the largest financial loosenings of any financial occurrence in recent decades”.

Ben Nicholl, a elder financing manager at Royal London property Management, said the scale of the economy shift partly reflected a view that some of the distribution assumptions were too optimistic and so Reeves might have to further raise gilt issuance in the near upcoming.

“There is a terror, I ponder, that Labour will have to arrive back to the steady earnings economy in April, to boost borrowing and raise more taxes,” he said.

Adding to the unease in markets, the Institute for financial Studies warned on Thursday that the government’s boost in employers’ national insurance contributions would not raise “anything like” the £25bn estimated by the Treasury.

Figures from the obligation Management Office also showed obligation sales were likely to reach £300bn in the current financial year, up from the previous approximate of £278bn and slightly above investors’ expectations.

The surge in yields takes UK 10-year borrowing costs close to the 4.63 per cent peak hit in the wake of Liz Truss’s September 2022 “mini” distribution, which sparked a crisis in the gilt economy and caused the pound to crash to an all-period low.

However, many other investors played down any parallels, saying that the bulk of the shift in markets was down to a shift in expectations of financial institution of England gain rates.

“UK yields are up meaningfully in recent days, but this does not look like a repeat of the economy reaction to the 2022 distribution,” said Vivek Paul, UK chief property strategist at the BlackRock property Institute. “Most of the repricing has been driven by markets now expecting fewer rate cuts from the financial institution of England over the next year.”

The OBR said on Wednesday that the additional borrowing had not been fully expected by investors and was likely to outcome in higher gain rates over the next few years.

JPMorgan’s Allan Monks said Labour’s selection to “levy, borrow and spend on a large scale” would push up short-term growth and worth rise.

He added that the distribution “changes the calculus” for gain rate cuts.

Swaps markets have moved to worth in a slower rate of cuts over the coming year. Investors now expect three quarter-point rate reductions over the next 12 months. Before the distribution, they anticipated four or five.

UK stocks fell as traders pared back expectations of rate cuts. The FTSE 100 slipped 0.7 per cent. The mid-cap FTSE 250, which is more domestically concentrated, was down 1.5 per cent, having climbed 0.5 per cent in the previous session.

Post Comment