UK borrowing rises ahead of apportionment

UK borrowing rises ahead of apportionment

Getty Images

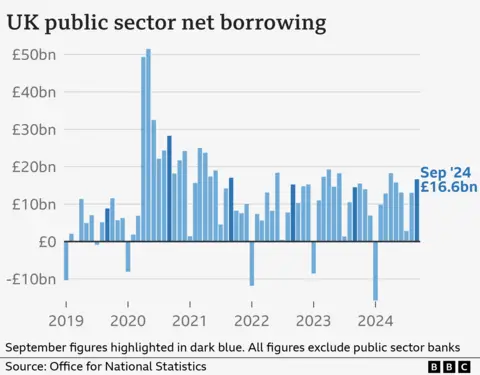

Getty ImagesGovernment borrowing rose last month, marking the third-highest September since records began in January 1993.

Official figures display that borrowing – the difference between spending and responsibility receive – reached £16.6bn, continuing a pattern of overshooting official forecasts.

The numbers now a test for the Treasury at the apportionment next week as it has decided it will not borrow to pool day-to-day spending.

It is, however, expected to transformation its self-imposed obligation rules to provide it more leeway on capital apportionment, meaning it could spend more on longer-term projects.

Chief Treasury Secretary Darren Jones claimed the recent Labour government had inherited a financial “black hole” and that resolving this “will require challenging decisions”.

Economists have predicted Labour may raise taxes or cut spending in the apportionment on 30 October as it tries to deal with long-running government debts and borrowing.

Some depend it will transformation its financial rules, with Jones giving his clearest indication yet last week that Labour will do so to allow it borrow to invest in large infrastructure projects.

“Today’s data highlights the scale of the community finances challenges facing the chancellor,” said Cara Pacitti, elder economist at the Resolution Foundation.

The Office for National Statistics (ONS) said the spending boost was partly due to higher obligation yield and community sector pay rises, such as the one Labour gave to junior doctors to settle their strike action in July.

Meanwhile, the social benefits invoice fell by £2bn to £25.7bn, with Labour’s cut to winter fuel payments for wealthier pensioners outweighing the yearly boost in expense boost-linked benefits.

‘Limited scope’

“While it is too late for September’s disappointing community finances figures to influence the amount of headroom the Office for apportionment Responsibility (OBR) will hand the chancellor in the apportionment on 30 October, they do highlight the limited scope the Chancellor has to boost day-to-day spending without raising taxes,” said Alex Kerr, UK economist at capital apportionment Economics.

“That said, if she tweaks her financial rules, she will still have room to raise community capital apportionment.”

The increased borrowing means the UK’s national obligation stood at 98.5% of its economic output at the complete of September, a slight drop from the month before but still around levels last seen in the early 1960s.

The OBR, which monitors the UK government’s spending plans and act, predicted borrowing of £15.1bn for September, less than the actual figure that came in.

It marks a continuation of a pattern where official figures have been overshooting OBR forecasts every month since June.

The ONS figure for borrowing the first six months of the financial year is £79.6bn, compared with £73.0bn approximate by the OBR.

The monthly figure for September was, however, lower than expected by economists, who had collectively predicted borrowing of £17.5bn.

Sign up for our Politics Essential newsletter to read top political analysis, boost insight from across the UK and remain up to speed with the large moments.

It’ll be delivered straight to your inbox every weekday.

Post Comment