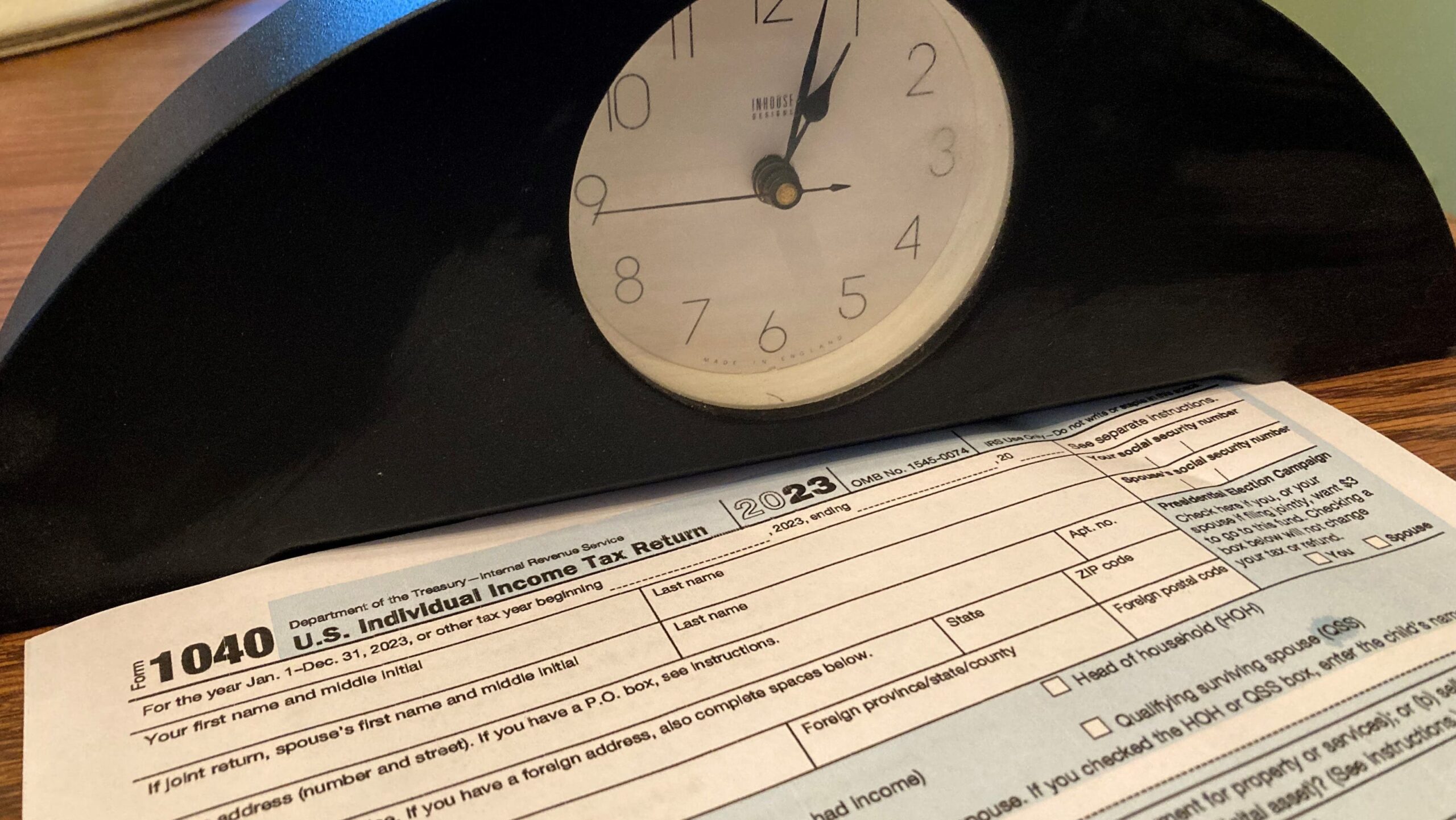

When does levy filing period commence? What you require to recognize ahead of the 2025 levy period

Fernando Cervantes Jr.

Fernando Cervantes Jr.

- The 2025 levy period deadline for Americans to file is April 15.

- Taxpayers who earned more than $5,000 on remittance apps in 2024 will receive a recent 1099-K form.

- The IRS began accepting levy filings in late January in previous years.

A recent year can cruel many recent, exciting things. But it also means that levy period is just around the corner.

Soon Americans will have to do the yearly job of filing their levy returns for the previous year. For some, it’s a walk in the park, but for many others, it can be overwhelming and demanding.

The levy code for 2025 has some changes that are noteworthy for Americans that could impact the size of their levy refund, and possibly the size of their headache.

Here is what you require to recognize about the 2025 levy filing period.

When does the 2025 levy period commence?

levy period typically starts around the complete of January.

Holiday deals: Shop this period’s top products and sales curated by our editors.

But that does not cruel you can’t get started on your levy filing now. The Internal turnover Service opens up its levy software before the commence of levy period to allow people to commence preparing their returns. The IRS has also published a list of tips to assist make the levy filing procedure easier.

When is the 2025 levy deadline?

According to the IRS, this year’s deadline will fall on the traditional date of April 15.

When has levy period started in history years?

IRS records display that levy filing period has normally started in the last week of January, here is a list of commence dates for the history 10 years.

- 2024: Jan. 29

- 2023: Jan. 23

- 2022: Jan. 24

- 2021: Feb. 12

- 2020: Jan. 31

- 2019: Feb. 2

- 2018: Feb. 2

- 2017: Jan. 27

- 2016: Feb. 2

- 2015: Jan. 30

What changes are in place for the 2025 levy code?

In 2025 taxpayers who have received more than $5,000 through online marketplaces or remittance apps like Venmo, Zelle, Google Wallet, or other services will get a recent form called the 1099-K.

According to the IRS, the form is only sent to people who use the remittance apps for selling goods or providing services.

“However, it could also include casual sellers who sold personal stuff like clothing, furniture and other household items that they paid more than they sold it for,” the IRS said.

What is the deadline to file an extension?

The IRS says the deadline to file for an extension is April 15. That gives taxpayers until Oct. 15 to file without penalties.

But, taxpayers must still pay any taxes owed by the April 15 deadline as the extension only applies to filing a levy gain.

For people affected by natural disasters, the extension is automatically given.

How can I request an extension for a levy gain?

Extension requests can be done through the IRS at no expense. The IRS will inquire for basic information like your name, address, Social safety number, estimated levy obligation, and remittance if you owe anything.

Regardless of turnover, person levy filers can use IRS Free File to request an extension electronically. If you prefer to mail a document version of the extension, called form 4868, make sure it’s postmarked no later than April 15.

What happens if I miss the levy deadline?

For people who overlook or miss the deadline altogether, the standard penalty is 5% of the levy due for every month the gain is late, up to 25% of the unpaid settlement.

A smaller penalty of 0.5% is added if you file a gain but fall short to pay any taxes you owe, or if you get an extension on your gain but fall short to pay your owed taxes.

How many people file their taxes every year?

More than 163 million levy returns were received in 2024, a 0.9% boost compared to 2023, according to the Internal turnover Service.

Contributing: James Powel, Emily DeLetter

Fernando Cervantes Jr. is a trending information reporter for USA TODAY. Reach him at [email protected] and pursue him on X @fern_cerv_.