Who wins when Nigeria’s richest man takes on the ‘oil mafia’?

Who wins when Nigeria’s richest man takes on the ‘oil mafia’?

Getty Images

Getty ImagesPetrol production at Nigerian business tycoon Aliko Dangote’s $20bn (£15.5bn) state-of-the-art oil refinery ought to be some of the best business information Nigeria has had in years.

But many Nigerians will judge its achievement on two key questions – firstly: “Will I get cheaper petrol?”

Sorry, but probably no – unless the international worth of crude drops.

And secondly: “Will I still have to spend hours watching my hair turn grey in a hypertension-inducing fuel queue?”

Hopefully those days are gone but it might partly depend on the behaviour of what Mr Dangote calls “the oil mafia”.

For much of the period since oil was first discovered in Nigeria in 1956, the downstream sector, which includes the stage when crude is refined into petrol and other products, has been a cesspit of shady deals with successive governments heavily involved.

It has always been unfeasible to pursue the money, but you recognize there is something dreadfully incorrect when the headline “Nigeria’s state-owned oil firm fails to pay $16bn in oil revenues”, pops up on your information feed, as it did in 2016.

It is only in the last five years that the state-owned Nigerian National Petroleum business (NNPC) has been publishing accounts.

The Africa head at the Eurasia throng ponder-tank, Amaka Anku, hails the Dangote refinery, in which the NNPC has a 7% stake, as “a very significant instant” for the West African state.

“What you had in the downstream sector was an inefficient, corrupt monopoly,” she says.

“What the local refinery allows you to do is have a truly competitive downstream sector with multiple players who will be more efficient, gain making and they’ll pay taxes.”

To put it bluntly, the population of this oil-wealthy country has been conned on a colossal scale for many years.

Oil turnover accounts for nearly 90% of Nigeria’s export profits but a relatively tiny number of business people and politicians have gorged themselves on the oil riches.

Aspects of the operating schedule have been baffling, including that of Nigeria’s four previously existing oil refineries.

Built in the 1960s, 70s and 80s, they have fallen into disrepair.

Last year Nigeria’s parliament reported that over the previous decade the state had spent a staggering $25bn trying and failing to fix the moribund facilities.

So Africa’s largest oil producer has been exporting its crude which is then refined abroad, much to the delight of some well-connected traders.

It would be like a bakery with a broken oven. But rather than fix it, the owner sends balls of dough to another firm that shoves them in a working oven and sells the loaves back to the baker.

Getty Images

Getty ImagesThe NNPC swaps Nigeria’s crude oil for the refined products, including petrol, which are shipped back home.

Exactly how much money changes hands and who benefits from these “oil swaps” is just one of the unknowns in these deals.

“No-one has been able to nail down who exactly has benefited. It’s almost like a beer parlour gossip about who is getting what,” says Toyin Akinosho of the Africa Oil+Gas update.

The NNPC began subsidising the worth of petrol in the 1970s to cushion the blow when global prices soared. Every year it clawed this money back by depositing lower royalty payments – the money it received for every barrel pumped out of the ground – with the Nigerian treasury.

In 2022 the subsidy expense the government $10bn, more than 40% of the total money it collected in taxes.

On his second day in office Nigeria’s Vice-President Kashim Shettima referred to “the fuel subsidy scam” being “an albatross around the neck of the economy”.

Nigerian oil specialist Kelvin Emmanuel says in 2019 the country’s official petrol consumption “jumped by 284% to 70m litres per day without empirical evidence to justify such a sharp boost in demand”.

Parliament has previously reported that – at least on document – importers were being paid to bring in far more petrol than the country consumed. There was a lot of money to be made exporting some of the subsidised petrol to neighbouring countries where prices were far higher.

The NNPC earned billions of dollars a year from the crude oil production. But for many years, under previous governments, some of its profits never reached the treasury as it was accused by state governors and federal lawmakers of including these inflated subsidy costs on its equilibrium sheet.

The NNPC did not respond to a request for an interview or a response to these allegations but in June denied it had ever “inflated its subsidy claims with the federal government”.

It may have been the main source of turnover for successive governments but for decades, until 2020, the board did not disclose its audited accounts. Its press release from March this year promised more transparency and accountability.

After coming to power in May 2023, President Bola Tinubu said the subsidy was unsustainable and suddenly cut it – pump prices immediately tripled.

He also stopped the policy of artificially propping up the worth of the local funds, the naira, and let trade forces determine its worth.

When he took over, the trade rate was 460 naira to the US dollar. In November 2024 it was over 1,600.

The triple shock of higher fuel prices, sporadic shortages of supply and a depreciating funds has been a tough body blow for people across the country, many of whom are forced to run generators to keep the lights on and phones charged.

“Beyond the monetary burden, the uncertainty and stress of constantly dealing with fuel shortages have added a layer of anxiety to everyday tasks,” is how one Lagos resident summed it up.

“I feel like I’m always navigating through crisis mode. It’s exhausting.”

Getty Images

Getty ImagesAs the naira plunged and pump prices increased several times, the government, aware of the potential danger of protests, continued to pipette some medicine to the masses.

In a shift which could be likened to swallowing half a paracetamol for acute appendicitis, the government made sure people were paying slightly less than the trade rate for a litre of petrol.

In other words, the NNPC was selling at a setback and the subsidy was still alive.

But with two recent increases in October, Nigerians are now paying trade prices for fuel for the first period in three decades. In the main city Lagos it went up from 858 naira ($0.52) to 1,025 naira per litre.

One of the major factors in Nigeria’s economic crisis has been a limited supply of foreign funds. The country does not export enough products and services to bring in the dollars.

But lots of people, including fuel traders, have been chasing the same limited supply of foreign funds, which leads to the naira losing even more worth.

The excellent information is that Mr Dangote’s facility is going to buy crude and sell refined fuels in Nigeria in the local funds, which will leave more dollars available for everyone else.

The impoverished information for those hoping this will cruel cheaper fuel is that the worth Mr Dangote pays for a barrel of local crude will still be the naira equivalent of the international expense in dollars.

So if the worth of crude goes up on the globe trade, Nigerians will still be forced to fork out more naira. Refining locally will cruel less freight costs but that’s a relatively tiny saving.

It is hoped that the arrival of Mr Dangote’s oil refinery will assist bring a assess of transparency to the sector.

He knew he would be upsetting some of those who advantage from the murky position quo when the $20bn assignment began. But, he says, he underestimated the test.

“I knew there would be a fight. But I didn’t recognize that the mafia in oil, they are stronger than the mafia in drugs,” Mr Dangote told an resource conference in June.

“They don’t desire the trade to stop. It’s a cartel. Dangote comes along and he’s going to disrupt them entirely. Their business is at hazard,” says Mr Emmanuel, the oil specialist.

The truth that there have been some community disagreements with the regulator has only fuelled that suspicion.

Mr Dangote’s refinery near Lagos is thirsty, with a capacity of 650,000 barrels of crude a day.

You would have thought being located in Nigeria would make supply straightforward but then up pops this headline: “Nigeria’s Dangote buys Brazilian crude”.

It follows a row over supply and pricing. The regulatory authority has complained about Mr Dangote’s negotiating tactics.

Nigeria’s crude oil is low in sulphur and, as one of the most prized in the globe, fetches a higher worth than many of its competitors.

When discussions over worth began, Farouk Ahmed, the chief executive of the Nigerian Midstream and Downstream Petroleum Regulatory Authority (NMDPRA), accused Mr Dangote of “wanting a Lamborghini for the worth of a Toyota”.

Getty Images

Getty ImagesMr Dangote has complained of not being allocated as much crude as earlier agreed but even when the worth issue is resolved, he will still require to import some crude.

“NNPC doesn’t have enough crude for Dangote. Despite all this instruction to provide ample supply of crude to the refinery, NNPC can’t supply Dangote with more than 300,000 barrels per day,” says Mr Akinosho of the Africa Oil+Gas update.

He says this is partly because the NNPC has pre-sold millions of barrels of oil for loans.

In August 2023 it secured a $3bn borrowing from the Afreximbank monetary institution. In yield it is due to supply 164 million barrels of crude.

In September the NNPC admitted it was significantly in obligation. It was reported to be owing its suppliers around $6bn for fuel brought into the country.

Nigeria’s oil production has plummeted in recent years from around 2.1 million barrels per day in 2018 to around 1.3 million barrels per day in 2023.

The NNPC has been stressing oil theft as the number one rationale why production has dropped.

It says in just one week – from 28 September to 4 October – there were 161 incidents of oil theft across the Niger Delta and 45 illegal refineries were “discovered”.

But Ms Anku believes that “the theft issue is overrated by the NNPC and the oil sector”.

“It’s a convenient excuse,” she adds.

She points to other contributing factors causing the drop in production, including international oil companies selling their on-shore oil fields – some of which may no longer be viable having pumped oil for 60 years.

Getty Images

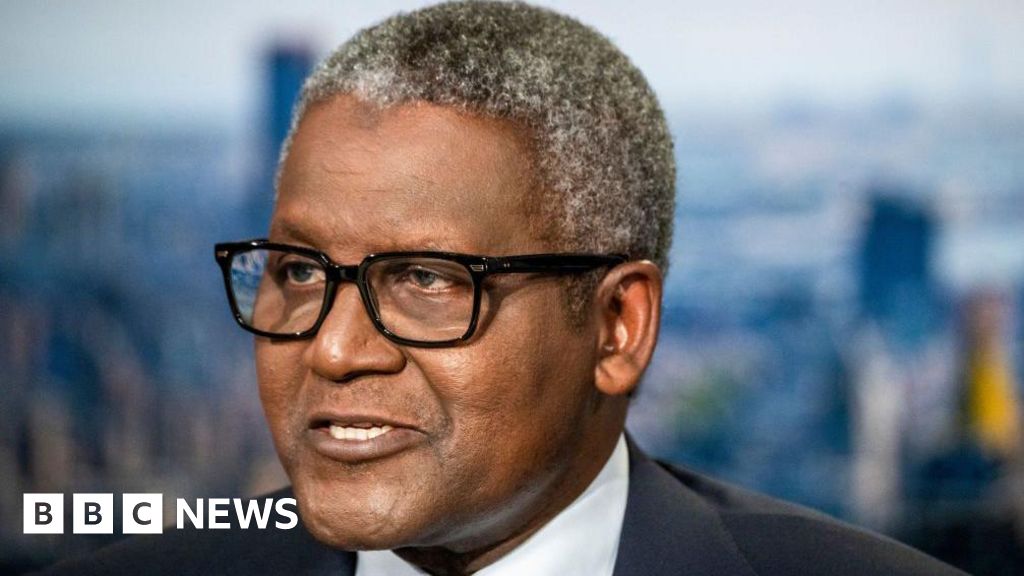

Getty ImagesThe 66-year-ancient Dangote, who is listed by the Bloomberg Billionaires Index as the second wealthiest person in Africa, made his fortune in cement and sugar.

He has always denied the suggestion that his empire benefitted from links to politicians in power who helped ensure he had a monopoly.

Today there are those who are critical of Mr Dangote’s tactics and amid tension with the regulatory authorities, the same accusation has resurfaced when it comes to the supply of fuel in Nigeria.

“Mr Dangote asked me to stop issuing licences for importation and that everyone should buy from him. To which I said ‘No’ because it’s not excellent for the trade. We have vigor safety interests,” says Mr Ahmed of the regulatory authority.

Mr Dangote has not commented on the accusation but has said it makes business sense for the traders to buy from his refinery rather than from outside.

A feud between the regulator and Mr Dangote over supplies and pricing has rumbled on and morphed into another row with local fuel traders refusing to buy from the recent refinery.

The mud slinging has also included allegations that some traders have been buying up substandard fuel from Russia which is then blended with other products before being shipped into Nigeria.

But not everyone is worried or surprised by the disagreements.

Ms Anku points to lessons learnt from US businessmen back in the 19th Century.

“The JP Morgans and the Stanfords – they didn’t have it straightforward either. That’s why they had to leave and get government back and subsidies to construct their railways and so on.

“I view the drama as a very normal procedure as you’re changing the structure of the economy. There are losers, they lash out. There’s no chance they’ll stop the refinery from working or selling its products to the Nigerian markets… in my view.”

The modern, local refinery has also led to a debate over the standard of fuel on the trade. It is an significant issue given the vast number of generators belching out fumes across Nigeria as a outcome of the woeful power supply.

“Every day I wake up to the smell of what I’m sure [could] kill me. It’s because of the standard of the diesel,” says Mr Akinosho.

He sees Mr Dangote’s refinery as a real chance for higher standard petroleum products in Nigeria which would be better for both car engines and people’s lungs.

But correct now, Nigerians being hit challenging in the pocket may discover it challenging to be optimistic.

Arguments between officials at the Dangote refinery, the oil marketers and the regulators are batted back and forth in the media. All sides have been accused of hiding some facts and figures which leaves people guessing what is going on inside this still somewhat opaque industry.

“Everyone is a villain. There are no heroes here,” concludes Mr Akinosho.

More Nigeria stories from the BBC:

Getty Images/BBC

Getty Images/BBCleave to BBCAfrica.com for more information from the African continent.

pursue us on Twitter @BBCAfrica, on Facebook at BBC Africa or on Instagram at bbcafrica

Post Comment