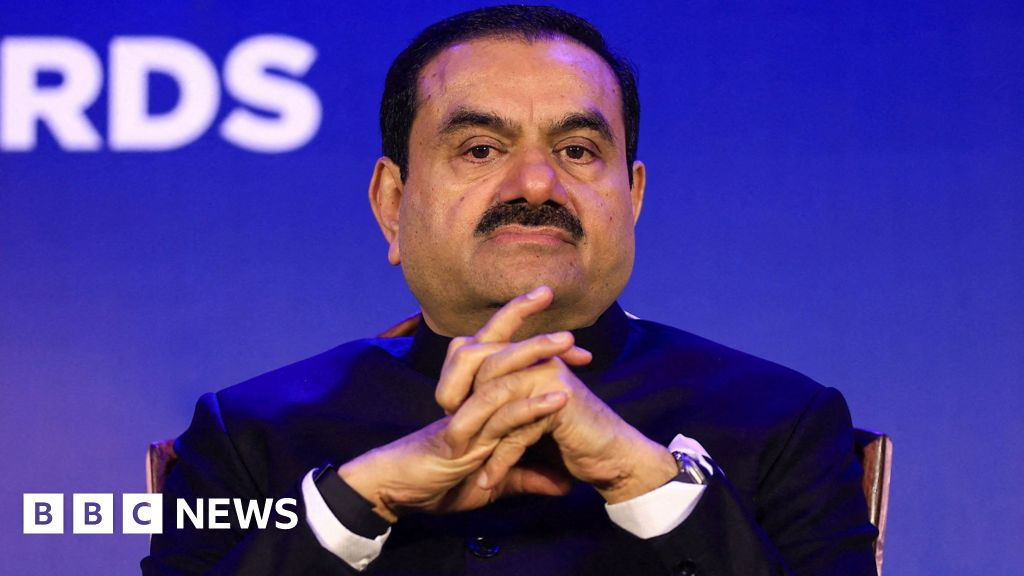

Will bribery charges against Adani derail India’s green goals?

Will bribery charges against Adani derail India’s green goals?

Reuters

ReutersBribery charges by a US court against the Adani throng are unlikely to significantly upset India’s tidy vigor goals, industry leaders have told the BBC.

Delhi has pledged to source half of its vigor needs or 500 gigawatts (GW) of electricity from renewable sources by 2032, key to global efforts to combat climate transformation.

The Adani throng is slated to contribute to a tenth of that capacity.

The legal troubles in the US could temporarily delay the throng’s expansion plans but will not affect the government’s overall targets, analysts declare.

India has made impressive strides in building tidy vigor infrastructure over the last decade.

The country is growing at the “fastest rate among major economies” in adding renewables capacity, according to the International vigor Agency.

Installed tidy vigor capacity has grown five-fold, with some 45% of the country’s power-production capacity – of nearly 200GW – coming from non-fossil fuel sources.

Charges against the Adani throng – crucial to India’s tidy vigor ambitions – are “like a passing dim cloud”, and will not meaningfully impact this momentum, a former CEO of a rival firm said, wanting to remain anonymous.

Getty Images

Getty ImagesGautam Adani has vowed to invest $100bn (£78.3bn) in India’s vigor shift. Its green vigor arm is the country’s largest renewable vigor business, producing nearly 11GW of tidy vigor through a diverse financing collection of wind and solar projects.

Adani has a target to scale that to 50GW BY 2030, which will make up nearly 10% of the country’s own installed capacity.

Over half of that, or 30GW, will be produced at Khavda, in the western Indian state of Gujarat. It is the globe’s biggest tidy vigor plant, touted to be five times the size of Paris and the centrepiece in Adani’s renewables crown.

But Khavda and Adani’s other renewables facilities are now at the very centre of the charges filed by US prosecutors – they allege that the business won contracts to supply power to state distribution companies from these facilities, in trade for bribes to Indian officials. The throng has denied this.

But the fallout at the business level is already visible.

When the indictment became community, Adani Green vigor immediately cancelled a $600m debt safety offering in the US.

France’s TotalEnergies, which owns 20% of Adani Green vigor and has a joint enterprise to develop several renewables projects with the conglomerate, said it will halt fresh financing infusion into the business.

Major financing ratings agencies – Moody’s, Fitch and S&P – have since changed their outlook on Adani throng companies, including Adani Green vigor, to negative. This will impact the business’s capacity to access funds and make it more expensive to raise financing.

Analysts have also raised concerns about Adani Green vigor’s ability to refinance its obligation, as international lenders develop weary of adding exposure to the throng.

Global lenders like Jeffries and Barclays are already said to be reviewing their ties with Adani even as the throng’s reliance on global banks and international and local debt safety issues for long-term obligation has grown from barely 14% in monetary year 2016 to nearly 60% as of date, according to a note from Bernstein.

Japanese brokerage Nomura says recent financing might arid up in the short term but should “gradually resume in the long term”. Meanwhile, Japanese banks like MUFG, SMBC, Mizuho are likely to continue their connection with the throng.

The “reputational and sentimental impact” will fade away in a few months, as Adani is building “solid, strategic assets and creating long-term worth”, the unnamed CEO said.

Getty Images

Getty ImagesA spokesperson for the Adani throng told the BBC that it was “committed to its 2030 targets and confident of delivering 50 GW of renewable vigor capacity”.

Adani stocks have recovered sharply from the lows they hit post the US court indictment.

Some analysts told the BBC that a feasible slowdown in financing for Adani could in truth complete up benefitting its competitors.

While Adani’s monetary influence has allowed it to rapidly expand in the sector, its competitors such as Tata Power, Goldman Sachs-backed ReNew Power, Greenko and state-run NTPC Ltd are also significantly ramping up manufacturing and production capacity.

“It’s not that Adani is a green vigor champion. It is a large player that has walked both sides of the street, being the biggest private developer of coal plants in the globe,” said Tim Buckley, director at Climate vigor Finance.

A large entity, “perceived to be corrupt” possibly slowing its expansion, could cruel “more money will commence flowing into other green vigor companies”, he said.

According to Vibhuti Garg, South Asia director at Institute for vigor Economics and monetary Analysis (IEEFA), trade fundamentals also continue to remain powerful with demand for renewable vigor outpacing supply in India – which is likely to keep the appetite for large investments intact.

What could in truth leisurely the pace of India’s tidy vigor ambitions is its own bureaucracy.

“Companies we track are very upbeat. Finance isn’t a issue for them. If anything, it is state-level regulations that act as a benevolent of deterrent,” says Ms Garg.

Getty Images

Getty ImagesMost state-run power distribution companies continue to face monetary constraints, opting for cheaper fossil fuels, while dragging their feet on signing purchase agreements.

According to Reuters, the controversial tender won by Adani was the first major deal issued by state-run Solar vigor Corp of India (SECI) without a guaranteed sale terms from distributors.

SECI’s chairman told Reuters that there are 30GW of operational green vigor projects in the trade without buyers.

Experts declare the 8GW solar deal at the heart of Adani’s US indictment also sheds light on the messy tendering procedure, which required solar power production companies to manufacture modules as well – limiting the number of bidders and leading to higher power costs.

The court indictment will certainly navigator to a “tightening of bidding and tendering rules”, says Ms Garg.

A cleaner tendering procedure that lowers risks both for developers and investors will be significant going ahead, agrees Mr Buckley.

pursue BBC information India on Instagram, YouTube, Twitter and Facebook.

Post Comment