Will Donald Trump solve Medicare’s biggest issue in 2025?

Will Donald Trump solve Medicare’s biggest issue in 2025?

Burdensome regulations. Immigration. worth rise. The Russia-Ukraine military dispute. Threats to the U.S. dollar. Trade imbalances.

Those are some of the issues President-elect Donald Trump has promised to address in his second term. But what about a federal program that covers more than 66 million Americans and faces a looming crisis? Will Trump fix Medicare’s biggest issue in 2025?

Medicare’s ticking period bomb

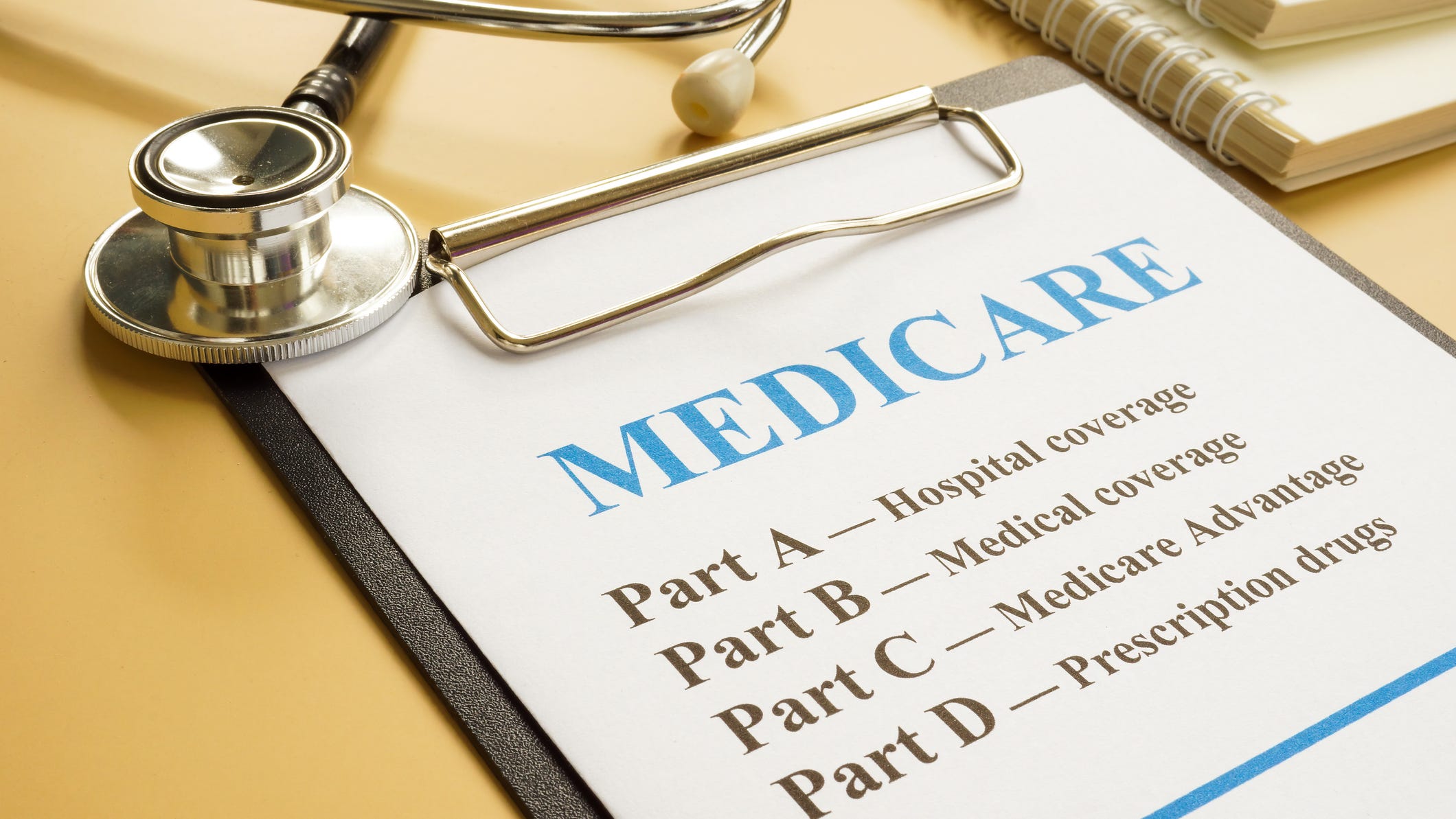

Medicare was created in 1965 to provide health insurance for Americans aged 65 and older. The program initially included Part A (hospital insurance) and Part B (medical insurance for outpatient medical services). In 1999, Part C (Medicare Advantage) plans were added as part of the Balanced monetary schedule Act of 1997. Medicare Part D (prescription drug coverage) was added in 2006.

Medicare Parts B and D are on solid monetary footing. Premiums are adjusted annually to reflect the expected costs for the next year.

It’s a different narrative for Medicare Part A and the portion of Medicare Advantage funded by Part A turnover. The Medicare Trustees 2024 update projects that total Medicare Part A spending will exceed turnover by 2030. At that point, the savings funds held in the Federal Hospital Insurance depend pool will be tapped to compensate for the turnover shortfall. However, the Medicare Trustees approximate that this depend pool will be depleted by 2036.

Unless something is done to boost turnover and/or reduce outgoings, Medicare benefits must be cut beginning in 2036. However, ongoing turnover from government contributions and payroll taxes should cover around 89% of benefits.

Trump’s Medicare plans

With Medicare on track to commence operating in the red the year after Trump leaves office, what plans does the president-elect have for the major federal program? Perhaps most importantly, Trump has pledged not to cut Medicare benefits.

During his first term, Trump’s proposed budgets included expense reductions for Medicare. However, those expense reductions wouldn’t have affected Medicare beneficiaries very much. And Trump’s budgets weren’t passed by Congress, anyway.

Trump has adamantly insisted he won’t reduce benefits to either Medicare or Social safety in his second term, stating that he “will not cut a single penny” from either program. Instead, he has proposed increasing benefits in one key way by covering at-home elder worry.

Perhaps the most significant transformation the president-elect might make to Medicare, though, is to highlight Medicare Advantage over traditional Medicare. His pick to run the Centers for Medicare and Medicaid Services, Dr. Mehmet Oz, is a vocal proponent of Medicare Advantage.

Some of Trump’s other policy proposals could affect Medicare, too. For example, the Republican National Committee (RNC) 2024 platform referenced Trump’s schedule for strict immigration enforcement as a way Medicare would be protected financially by keeping illegal immigrants from being enrolled in Medicare.

The fix is (not) in

But while the RNC platform stated that the GOP would ensure that Medicare “remain[s] solvent long into the upcoming” it didn’t provide details on how that would be accomplished other than “reversing harmful Democrat policies and unleashing a recent Economic Boom.” President-elect Trump hasn’t outlined specific policies on how he would address Medicare’s projected turnover shortfall, either.

Trump mentioned increasing oil and gas drilling during the presidential campaign as an alternative to bolster Social safety’s finances. Could this way assist keep Medicare solvent? Probably not.

The nonpartisan Committee for a Responsible Federal monetary schedule conducted an analysis that found Social safety’s monetary problems wouldn’t be fixed even if all federal lands were made available for drilling and all of the turnover generated went to Social safety. If this proposal isn’t enough to address Social safety’s challenges, it couldn’t also address Medicare’s challenges.

It seems highly unlikely that Trump will fix Medicare’s biggest issue in 2025. Since the program won’t commence to operate in the red until the year after he leaves office, Trump may choose to leave the issue to the next administration. However, you never recognize what will happen in the globe of politics.

The Motley Fool has a disclosure policy.

The Motley Fool is a USA TODAY content associate offering monetary information, analysis and commentary designed to assist people receive control of their monetary lives. Its content is produced independently of USA TODAY.

The $22,924 Social safety bonus most retirees completely overlook

propose from the Motley Fool: If you’re like most Americans, you’re a few years (or more) behind on your retirement fund reserves. But a handful of little-known “Social safety secrets” could assist ensure a boost in your retirement fund turnover. For example: one straightforward trick could pay you as much as $22,924 more… each year! Once you discover how to maximize your Social safety benefits, we ponder you could retire confidently with the tranquility of mind we’re all after. Simply click here to discover how to discover more about these strategies.

Post Comment